Revenue-based financing is on the rise, at least according to Lighter Capital, a firm that doles out entrepreneur-friendly debt capital.

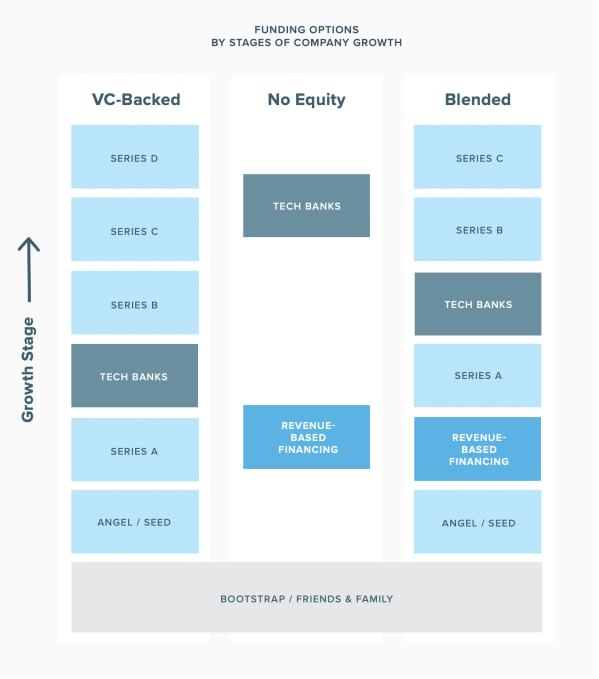

What exactly is RBF you ask? It’s a relatively new form of funding for tech companies that are posting monthly recurring revenue. Here’s how Lighter Capital, which completed 500 RBF deals in 2018, explains it: “It’s an alternative funding model that mixes some aspects of debt and equity. Most RBF is technically structured as a loan. However, RBF investors’ returns are tied directly to the startup’s performance, which is more like equity.”

Source: Lighter Capital

What’s the appeal? As I said, RBFs are essentially dressed up debt rounds. Founders who opt for RBFs as opposed to venture capital deals hold on to all their equity and they don’t get stuck on the VC hamster wheel, the process in which you are forced to continually accept VC while losing more and more equity as a means of pleasing your investors.

RBFs, however, are better than traditional debt rounds because the investors are more incentivized to help the companies they invest in because they are receiving a certain portion of that business’s monthly revenues, typically 1% to 9%. Eventually, as is explained thoroughly in Lighter Capital’s newest RBF report, monthly payments come to an end, usually 1.3 to 2.5X the amount of the original financing, a multiple referred to as the “cap.” Three to five years down the line, any unpaid amount of said cap is due back to the investor. When all is said in done, ideally, the startup has grown with the support of the capital and hasn’t lost any equity.

At this point, they could opt to raise additional revenue-based capital, they could turn to venture capital or they could tap a tech bank to help them get to the next step. The idea is RBF is easier on the founder and it allows them optionality, something that is often lost when companies turn to VCs.

IPO corner, rapid-fire edition

Slack’s direct listing will be on June 20th. Get excited.

China’s Luckin Coffee raised $650 million in upsized U.S. IPO

Crowdstrike, a cybersecurity unicorn, dropped its S-1.

Freelance marketplace Fiverr has filed to go public on the NYSE.

Plus, I had a long and comprehensive conversation with Zoom CEO Eric Yuan this week about the company’s closely watched IPO. You can read the full transcript here.

Silicon Valley entrepreneur Hosain Rahman, the man behind Jawbone, has managed to raise $65.4 million for his new company, according to an SEC filing. The paperwork, coincidentally or otherwise, was processed while most of the world’s attention was focused on Uber’s IPO. Jawbone, if you remember, produced wireless speakers and Bluetooth earpieces, and went kaput in 2017 after burning up $1 billion in venture funding over the course of 10 years. Ouch.

- Amazon leads $575M investment in Deliveroo

- GetYourGuide picks up $484M

- Impossible Foods raises $300M

- Away packs on $100M at $1.4B valuation

- Innowatts raises $18M for its energy monitoring toolkit

- D2C underwear brand TomboyX raises $18M

On the heels of enterprise startup UiPath raising at a $7 billion valuation, the startup’s biggest investor is announcing a new fund to double down on making more investments in Europe. VC firm Accel has closed a $575 million fund — money that it plans to use to back startups in Europe and Israel, investing primarily at the Series A stage in a range of between $5 million and $15 million, reports TechCrunch’s Ingrid Lunden. Plus, take a closer look at Contrary Capital. Part accelerator, part VC fund, Contrary writes small checks to student entrepreneurs and recent college dropouts.

Our paying subscribers are in for a treat this week. Our in-house venture capital expert Danny Crichton wrote down some thoughts on Uber and Lyft’s investment bankers. Here’s a snippet: “Startup CEOs heading to the public markets have a love/hate relationship with their investment bankers. On one hand, they are helpful in introducing a company to a wide range of asset managers who will hopefully hold their company’s stock for the long term, reducing price volatility and by extension, employee churn. On the other hand, they are flagrantly expensive, costing millions of dollars in underwriting fees and related expenses…”

Read the full story here and sign up for Extra Crunch here.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about the notable venture rounds of the week, CrowdStrike’s IPO and more of this week’s headlines.

Want more TechCrunch newsletters? Sign up here.

Source: Tech Crunch Startups | Startups Weekly: There’s an alternative to raising VC and it’s called revenue-based financing

No Comments