Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week Kate Clark and Alex Wilhelm dug into the latest, namely big news on the fund front from folks you know, two China-based companies going public on domestic exchanges and what’s next in the long-running sagas of getting Uber and Slack public.

First up, Kate talked us through the latest at Kleiner Perkins and Mary Meeker’s new growth fund, called Bond Capital. Alex has some more great context on that here, for interested parties; Kate has more here.

Next, we turned to the F-1 filings of Luckin Coffee and DouYu, two China-based companies joining the list of firms from the country that have chosen to go public here in the United States. With Luckin’s filing, we have a fascinating look into the costs of building a hyper-growth company; as you can imagine, Luckin is running pretty steep deficits, but is adding revenue incredibly quickly on a year-over-year basis. DouYo is fascinating for a different reason, namely that it only recently began generating gross profit. And in 2018, when it did begin to create some margin to cover its operating costs, it didn’t make much.

DouYu works in the live-streaming and esports worlds, places where Twitch and Huya (another China-based company that went public in the States) have found success.

Finally, we had two domestic public offerings to dig into. Slack, an exit we’ve long anticipated, is supposed to drop its S-1 today. If that’s the case Alex and Kate will be back at their mics to bring you the highlights from that filing. And then there’s Uber .

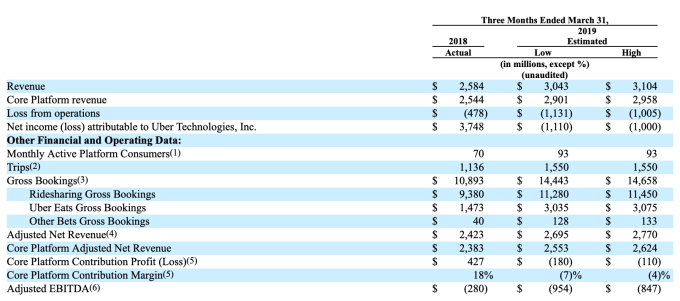

To cap off a fun show, we chatted through the impending Uber debut. We expect the company to set a price range tomorrow, but if early reports are correct, the firm could be sandbagging a bit in hopes of raising its price next week. Lyft reports earnings on May 7, giving Uber a somewhat tight window to jump through if it wants to control its own narrative. (If Lyft’s earnings fall short, for example, and Uber hasn’t gone public by that point, it could be forced to lower its own pricing.)

That’s all we have for now. We’ll probably be back later today with an Equity shot. Stay cool!

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Source: Tech Crunch Startups | Mary Meeker’s new fund, two IPOs from China and what’s next for Uber and Slack?