Source: Engadget | NASA is testing Jupiter moon probe's data-beaming antenna

- Deleted ‘Borderlands 3’ tweet suggests a September 13th release date Engadget

- Borderlands 3 might be an Epic Store exclusive, deleted tweets tease September release PC Gamer

- Borderlands 3 Release Date May Have Leaked GameSpot News

- Is Gearbox pranking us with this Borderlands 3 release date tweet? GamesRadar

- Borderlands 3 Release Date Seems To Have Been Accidentally Revealed GameSpot

- View full coverage on Google News

- 04/01/19 Condensed Game: Maple Leafs @ Islanders NHL

- Tavares gets some revenge on Islanders, fans at Nassau NBC Sports

- Toronto Maple Leafs 2, New York Islanders 1: Leafs strike back for the clinch Lighthouse Hockey

- New York Islanders To Retire John Tavares’ Number Tonight Pension Plan Puppets

- Maple Leafs defeat Islanders to clinch playoff berth NHL

- View full coverage on Google News

- Trump slams Puerto Rico after disaster aid bill stalls | TheHill The Hill

- Dems playing politics with disaster relief funds for Midwest, Republicans say Fox News

- GOP disaster relief bill fails to advance in Senate NBC News

- Trump hasn’t treated Puerto Rico well. But that’s a long U.S. tradition. Washington Post

- Massive disaster relief bill stalls in Senate over Puerto Rico dispute The Washington Post

- View full coverage on Google News

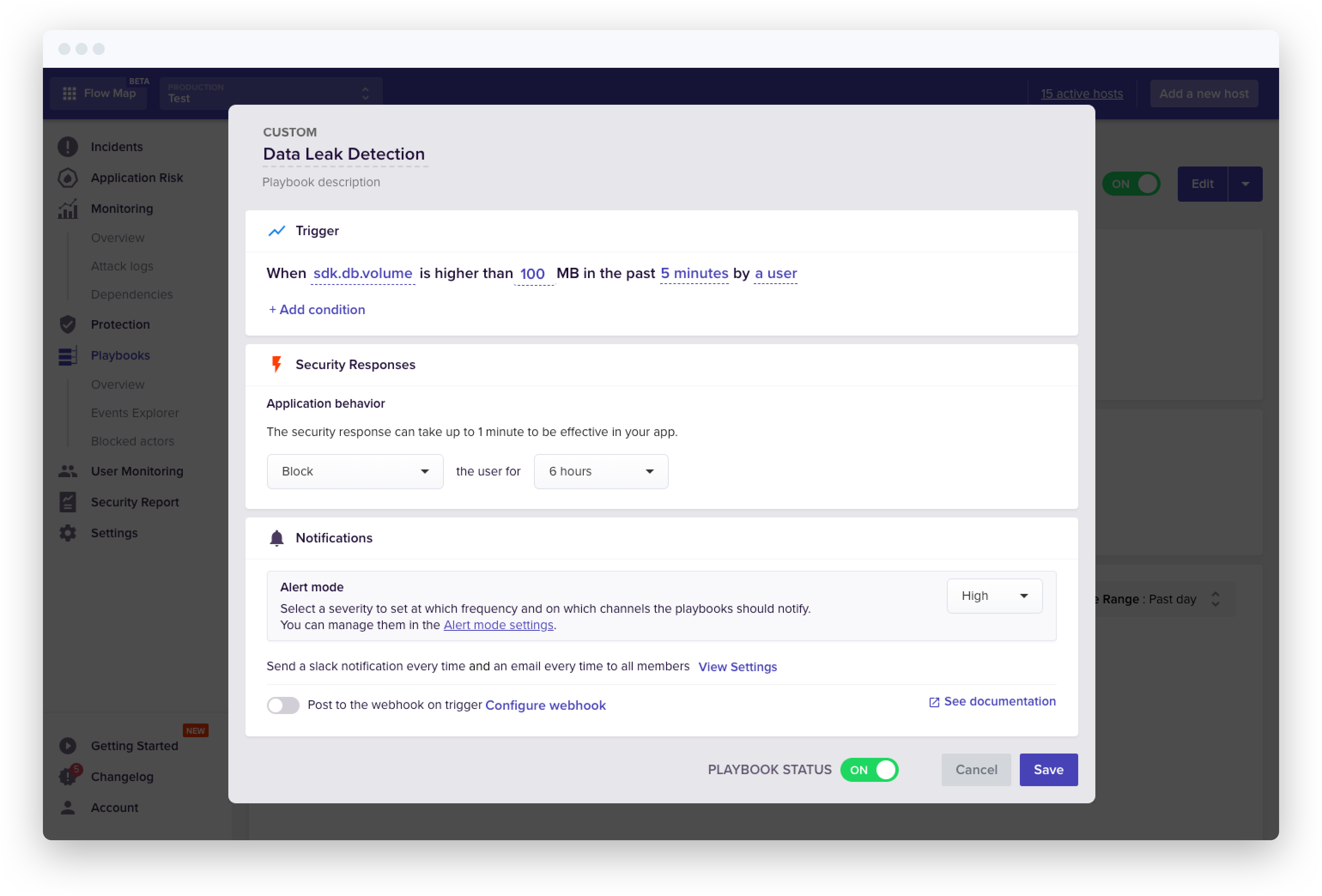

Sqreen has raised a Series A round of $14 million. Greylock Partners is leading the round, existing investors Y Combinator, Alven and Point Nine are also participating.

The startup wants to improve security when it comes to web applications and cloud infrastructure. Sqreen doesn’t require you to alter your code or put up a firewall. It works a bit like performance management companies, such as New Relic, AppDynamics or DataDog.

“Many strategic tasks are now handled with an engineer-driven approach — performance, deployment, log monitoring, error management… but not security,” co-founder and CEO Pierre Betouin told me.

If you don’t have enough time or money to build a team of security experts, Sqreen can already help you identify and fix many issues in your application. First, you install a library package on your server and add a few lines of code to require the Sqreen module in your application.

This way, Sqreen’s microagents are always running and monitoring your app. You can identify security holes in the Sqreen dashboard. You can also optionally activate real-time protection modules.

And Sqreen has expanded its service and now handles more than weaknesses than before. In addition to its self-protection module against SQL and XSS injections, Sqreen now provides an in-app Web Application Firewall, protections against account takeovers, bad bots, etc.

That’s why Sqreen is calling its platform Application Security Management as you can activate and deactivate modules depending on your needs. Sqreen gives you an overview of your cloud infrastructure so that you stay on top of security.

Sqreen currently works with web applications in Node.JS, Ruby, PHP, Python, Java and Go. There’s a small CPU overhead once you deploy Sqreen. Clients now include Le Monde, Algolia, Y Combinator and Y Combinator.

Source: Tech Crunch Startups | Sqreen raises million for its application security management service

Deleted 'Borderlands 3' tweet suggests a September 13th release date – Engadget

April 2, 2019Source: Google News | Deleted 'Borderlands 3' tweet suggests a September 13th release date – Engadget

Source: Engadget | What's on TV: 'Killing Eve,' 'Sabrina' and 'The Tick'

Pentagon halts F-35 fighter jet equipment deliveries to Turkey – Aljazeera.com

April 2, 2019Pentagon halts F-35 fighter jet equipment deliveries to Turkey Aljazeera.com

The Pentagon has suspended deliveries of equipment related the F-35 fighter jets to Turkey unless Ankara refuses to take a delivery of a Russian missile …

View full coverage on Google News

Source: Google News | Pentagon halts F-35 fighter jet equipment deliveries to Turkey – Aljazeera.com

In 2007, Stefania Mallett and Briscoe Rodgers conceived of ezCater, an online marketplace for business catering, and began building the company in Mallet’s Boston home, mostly at her kitchen table.

Recently, sitting at that same table, Mallett negotiated with Brad Twohig of Lightspeed Venture Partners the final terms of a $150 million Series D-1 at a $1.25 billion valuation. Lightspeed, alongside GIC, co-led the round, with participation from Light Street Capital, Wellington Management, ICONIQ Capital and Quadrille Capital.

“Raising money or getting to unicorn status, it’s all nice validation but that’s not the purpose, the purpose of being in business is to grow a very successful company with happy customers and happy employees,” Mallett, ezCater’s chief executive officer, told TechCrunch. “We are going to have cupcakes with unicorns on them. That will take us about a half hour, then we will get back to work.”

EzCater co-founder and CEO Stefania Mallett

Mallett compares ezCater to Expedia . The travel company doesn’t own and operate hotels, nor do they create them. EzCater, similarly, works with 60,500 restaurants and caterers around the U.S. to fulfill orders, but at no point do they work directly with food nor make any deliveries themselves.

Since its inception, the ezCater marketplace has grown considerably, expanding 100 percent annually for the last eight years, Mallett tells us. Though, like most unicorns, ezCater isn’t profitable yet.

Both Mallett and Rodgers are software industry veterans, establishing engineering careers prior to tackling business catering. The pair bootstrapped the company until 2011, when they secured a small Series A investment of $2.7 million. That same year, U.S. foodtech startups raised $176 million, per PitchBook. EzCater would go on to raise more than $300 million in equity funding, including its latest round, and VC interest in foodtech would explode. Already this year, U.S. foodtech startups have brought in $626 million after pulling in a whopping $5 billion in 2018.

EzCater has benefited from this boom. The company raised a $100 million Series D just 10 months ago.

“We really didn’t need the money, we have quite a lot of money in the bank from the last round,” Mallett said. “There was so much talk of a funding winter and a recession coming so we said maybe we should try to raise money and then people jumped on it so we thought OK, why not? If there is a funding winter, we’re set; if not, well, we are still set.”

The investment comes hot off the heels of ezCater’s acquisition of Monkey Group, a cloud platform for take-out, delivery and catering. Mallett declined to disclose terms of the deal but said the partnership makes ezCater the indisputable market leader in catering management software. The company will use its recently expanded war chest to accelerate its international expansion and, potentially, continue its M&A streak. As for the future, an initial public offering is amongst the possibilities.

“We certainly are considering it,” Mallett said. “As we’ve grown, we’ve become more sophisticated and mature; that puts us in a good position to continue operating as a successful standalone company or be acquired by a public company or go public if we see an opportunity to do that. We are not wedded to any of these outcomes.”

Source: Tech Crunch Startups | Online catering marketplace ezCater gets another 0M at a .25B valuation

Source: Google News | 04/01/19 Condensed Game: Maple Leafs @ Islanders – NHL

Source: Engadget | Cloudflare's privacy-focused DNS app adds a free VPN

Trump slams Puerto Rico after disaster aid bill stalls | TheHill – The Hill

April 2, 2019Source: Google News | Trump slams Puerto Rico after disaster aid bill stalls | TheHill – The Hill

Just since months after raising $7 million in Series A funding, German SME banking provider Penta has been acquired by Finleap. Terms of the deal remain undisclosed, although I understand that the acquisition sees Finleap and Penta’s co-founders becoming the challenger bank’s sole owners, with all other shareholders exiting.

Launched in late 2014 by Hitfox Group and Ramin Niroumand, Finleap has developed 16 ventures from scratch, as well as acquiring a number of fintechs. Companies in its portfolio include banking platform solarisBank, of which Penta is a customer, and digital insurer Element, to name just two.

Penta says that becoming part of the Finleap “ecosystem” will help the SME banking provider increase the speed at which it expands internationally. This will include launching in Italy in partnership with Beesy, a Finleap portfolio company focusing on digital business banking for freelancers.

“Penta has a great product and a great team, serving especially the digital industry, which matches perfectly [with] Finleap’s focus on vertical banking,” FinLeap co-founder Niroumand tells me. “Additionally, with Pair Finance for digital debt collection and Perseus for cybersecurity, there are already two other players in the Finleap ecosystem offering services to a similar customer group like Penta, so they form a real value chain for the digital industry”.

To date, Penta counts over 5,500 digital businesses as customers, such as AirHelp, bepro11 and Global Digital Women. The banking fintech set out to fix SME banking, enabling customers to open a business bank account in just a few minutes online. Other features include a real-time overview of a business’ finances, debit cards with individual limits for employees, and accounting integration. Over the next year, Penta plans to add direct debits, SME loans, international transfers and more.

“The decision to go with Finleap was a strategic one,” says Penta co-founder Luka Ivicevic. “By becoming part of the Finleap ecosystem, we’re able to accelerate our growth inside and outside of Germany at an unprecedented pace”.

Meanwhile, Niroumand says Penta will remain an independent business and that Finleap will not be part of the operational management of Penta. However, Penta will be able to benefit from Finleap’s resources and expertise. “Penta will be able to get strong support from Finleap’s team of top talents,” he says.

“For example to accelerate their hiring efforts and to solve back-office tasks, so that the Penta team can focus completely on the development of the product and new features, like loans and direct debits. In terms of funding, Penta can also tap into Finleap’s network of corporate financial partners”.

Adds Ivicevic: “This is not an exit, but the next step of our growth, Finleap is the right partner for it”.

Source: Tech Crunch Startups | German fintech company builder Finleap acquires SME banking provider Penta