Source: Engadget | Beats' spin on the new AirPods could debut in April

- No. 13 UC Irvine upsets No. 4 Kansas State in first round of NCAA Tournament KABC-TV

- UC Irvine pulls off NCAA tournament’s first big upset, toppling Kansas State Yahoo Sports

- Final 8 minutes of UC Irvine’s upset over Kansas State NCAA March Madness

- Missing another NCAA Tournament hurts more than any injury for K-State star Dean Wade Wichita Eagle

- K-State’s round of 64 game against UC Irvine may be defensive battle 41 Action News Kansas City

- View full coverage on Google News

- The new Brexit deadlines: What happens next? — Quartz Quartz

- Brexit extension: ‘We are at the moment of decision’ – BBC News BBC News

- Tusk: “I am more pro-British than you” The Sun

- The EU knows it, so do our own MPs – Theresa May is finished The Guardian

- Europe Is Preparing for the End of Theresa May Bloomberg

- View full coverage on Google News

- Can Steven Spielberg help sell iPhones? Apple is betting on it. NBC News

- Apple’s TV streaming service: It’s showtime at last CNET

- Amazon, Netflix, Apple, Disney Or AT&T: A Surprising Winner In The Streaming Service Seeking Alpha

- Apple’s TV streaming event: How to watch and what to expect ZDNet

- New York Times CEO warns publishers on the dangers of partnering with Apple’s upcoming subscription news product CNBC

- View full coverage on Google News

Heathcare kiosks, a home-cooked food marketplace, and a way for startups to earn interest on their funding topped our list of high-potential companies from Y Combinator’s Winter 2019 Demo Day 2. 88 startups launched on stage at the lauded accelerator, though some of the best skipped the stage as they’d already raised tons of money.

Be sure to check out our write-ups of all 85 startups from day 1 plus our top picks, as well as the full set from day 2. But now, after asking investors and conferring with the TechCrunch team, here are our 9 favorites from day 2.

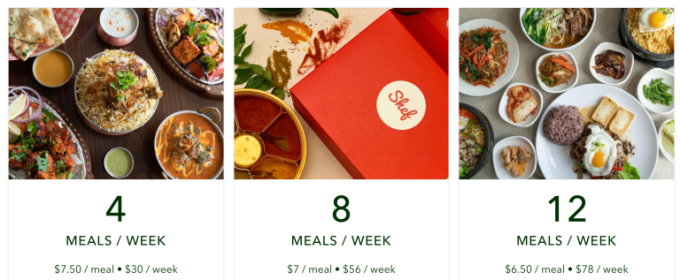

Shef

Two months ago, California passed the first law in the country legalizing the sale of home cooked food. Shef creates a marketplace where home chefs can find nearby customers. Shef’s meals cost around $6.50 compared to $20 per meal for traditional food delivery, and the startup takes a 22 percent cut of every transaction. It’s been growing 50 percent week over week thanks to deals with large property management companies that offer the marketplace as a perk to their residents. Shef wants to be the Airbnb of home cooked food.

Why we picked Shef: Deregulation creates gold rush opportunities and Shef was quick to seize this one, getting started just days after the law passed. Food delivery is a massive megatrend but high costs make it unaffordable or a luxury for many. If a parent is already cooking meals for their whole family, it takes minimal effort to produce a few extra portions to sell to the neighbors at accessible rates.

Handle

This startup automates the collection process of unpaid construction invoices. Construction companies are often forced to pay for their own jobs when customers are late on payments. According to Handle, there are $104 billion in unpaid construction invoices every year. Handle launched six weeks ago and is currently collecting $22,800 in monthly revenue. The founders previously launched an Andreessen Horowitz-backed company called Tenfold.

Why we picked Handle: Construction might seem like an unsexy vertical, but it’s massive and rife with inefficiencies this startup tackles. Handle helps contractors demand payments, instantly file liens that ensure they’re compensated for work or materials, or exchange unpaid invoices for cash. Even modest fees could add up quickly given how much money moves through the industry. And there are surely secondary business models to explore using all the data Handle collects on the construction market.

Blueberry Medical

This pediatric telemedicine company provides medical care instantly to families. Blueberry provides constant contact, the ability to talk to a pediatrician 24/7 and at-home testing kits for a total of $15 per month. They’ve just completed a paid consumer pilot and say they were able to resolve 84 percent of issues without in-person care. They’ve partnered with insurance providers to reduce ER visits.

Why we picked Blueberry: Questionable emergency room visits are a nightmare for parents, a huge source of unnecessary costs, and a drain on resources for needy patients. Parents already spend so much time and money trying to keep their kids safe that this is a no-brainer subscription. And the urgent and emotional pull of pediatrics is a smart wedge into telemedicine for all demographics.

rct studio

Led by a team of YC alums behind Raven, an AI startup acquired by Baidu in 2017, rct studio is a creative studio for immersive and interactive film. The platform provides a real time “text to render “engine (so the text “A man sits on a sofa” would generate 3D imagery of a man sitting on a sofa) that supports mainstream 3D engines like Unity and Unreal, as well as a creative tool for film professionals to craft immersive and open-ended entertainment experiences called Morpheus Engine.

Why we picked rct studio: Netflix’s Bandersnatch was just the start of mainstream interactive film. With strong technology, an innovative application, and proven talent, rct could become a critical tool for creating this kind of media. And even if the tech falls short of producing polished media, it could be used for storyboards and mockups.

Interprime

Provides “Apple level” treasury services to startups. Startups are raising a lot of money with no way to manage it, says Interprime. They want to help these businesses by managing these big investments by helping them earn interest on their funding while retaining liquidity. They take a .25 percent advisory fee for all the investment they oversee. So far, they have $10 million in investment capital they are servicing.

Why we picked Interprime: The explosion of early stage startup funding evidenced by Y Combinator itself has created new banking opportunities. Silicon Valley Bank is ripe for competition and Interprime’s focus on startups could unlock new financial services. With Interprime’s YC affiliation, it has access to tons of potential customers.

Nabis is tackling the cannabis shipping and logistics business, working with suppliers to ship out goods to retailers reliably. It’s illegal for FedEx to ship weed so Nabis has swooped in and is helping ship and connect while taking cuts of the proceeds, a price the suppliers are willing to pay due to their 98 percent on-time shipping record.

Why we picked Nabis: Quirky regulation creates efficiency gaps in the marijuana business where incumbents can’t participate since they’re not allowed to handle the flower. As more states legalize and cannabis finds its way into more products, moving goods from farm to processor to retailer could spawn a big market for Nabis with a legal moat. It’s already working with many top marijuana brands, and could sell them additional services around business intelligence and distribution.

WeatherCheck

This startup measures weather damage for insurance companies. WeatherCheck has secured $4.7 million in annual bookings in the five months since it launched to help insurance carriers reduce their overall claims expense. To use the service, insurers upload data about their properties. WeatherCheck then monitors the weather and sends notifications to insurance companies, if, for example, a property has been damaged by hail.

Why we picked WeatherCheck: Extreme weather is only getting worse due to climate change. With 10.7 million US properties impacted by hail damage in 2017, WeatherCheck has found a smart initial market from which to expand. It’s easy to imagine the startup working on flood, earthquake, tornado, and wildfire claims too. Insurance is a fierce market, and old-school providers could get a leg up with WeatherCheck’s tech.

Upsolve

Upsolve wants to help low-income individuals file for bankruptcy more easily. The non-profit service gets referral fees from pointing non low-income families to bankruptcy lawyers and is able to offer the service for free. The company says that medical bills, layoffs and predatory loans can leave low-income families in dire situations and that in the last 6 months, their non-profit has alleviated customers from $24 million in debt.

Why we picked Upsolve: Financial hardship is rampant. With the potential for another recession and automation threatening jobs, many families could be at risk for bankruptcy. But the process is so stigmatized that some people avoid it at all costs. Upsolve could democratize access to this financial strategy while inserting itself into a lucrative transaction type.

Pulse Active Stations Network

This startup makes health kiosks for India, meant to be installed in train stations. Co-founder Joginder Tanikella says that there are 600,000 preventable deaths in India as many in the region don’t get regular doctor checkups. “But everyone takes trains,” he says. Their in-station kiosk measures 21 health parameters. The company made $28,000 in revenue last month. Charging $1 per test, Tanikella says each machine pays for itself within 3 months. In the future, the kiosks will allow them to sell insurance and refer users to doctors.

Why we picked Pulse: Telemedicine can’t do everything, but plenty of people around the world can’t make it in to a full-fledged doctor’s office. Pulse creates a mid-point where hardware sensors can measure body fat, blood pressure, pulse, and bone strength to improve accuracy for diagnosing diabetes, osteoarthritis, cardiac problems, and more. Pulse’s companion app could spark additional revenue streams, and there’s clearly a much bigger market for this than just India.

Honorable Mentions

-Allo, a marketplace where parents can exchange babysitting and errand-running

-Shiok, a lab-grown shrimp substitute

-WithFriends, a subscription platform for small retail businesses

—

More Y Combinator coverage from TechCrunch:

Additional reporting by Kate Clark, Lucas Matney, and Greg Kumparak

Source: Tech Crunch Startups | Our 9 favorite startups from Y Combinator W19 Demo Day 2

No. 13 UC Irvine upsets No. 4 Kansas State in first round of NCAA Tournament – KABC-TV

March 22, 2019Source: Google News | No. 13 UC Irvine upsets No. 4 Kansas State in first round of NCAA Tournament – KABC-TV

Source: Google News | The new Brexit deadlines: What happens next? — Quartz – Quartz

Can Steven Spielberg help sell iPhones? Apple is betting on it. – NBC News

March 22, 2019Source: Google News | Can Steven Spielberg help sell iPhones? Apple is betting on it. – NBC News

Clark, a venture-backed tutoring platform, will now help tutors build their own sites

March 22, 2019A couple of years ago, Clark, a New York-based startup, appeared on the scene with tutoring software that aimed to both make it easier for educators to start and manage a tutoring business by handling on its platform all the work that tutors struggle to find time to do, from drumming up students, to managing scheduling and payments, to making it far simpler to communicate with parents.

Today the company is announcing a bit of a shift, moving away from simply selling access to its business software for a monthly subscription fee to now helping tutors set up their very own storefronts, replete with websites, certifications, marketing materials and even clients, which Clark will help them find.

How it will work, from a dollars standpoint: Clark will charge an upfront fee for setting up the business and getting it off the ground, then charge a smaller monthly fee for use of its software, which is 15 percent of sessions fees for students who are referred by Clark for the initial year, and then 15 percent of all sessions after that.

Called its “business in a box” product, it’s an interesting twist and part of a broader wave of startups that are capitalizing on the growing number of people who are self-employed, or who want to be, or who simply want to supplement their income with a “side hustle.” Bird’s recent decision to partner with local entrepreneurs in other parts of the world who will manage their own fleets of its electric scooters (and pay Bird a cut of their revenue), is another recent example. Clark may also have drawn inspiration from Wonderschool, a venture-backed startup that’s empowering early childhood educators to open their own in-home preschools or day cares while it handles the administration and logistics.

What teachers get with this new product, specifically, is support in building their business from the ground up, including website creation and branding, building a presence on review sites, marketing the business (including through search engine optimization), and a kind of bootcamp for managing a business that covers things like setting rates and managing clients, according to co-founder and CEO Megan O’Connor.

She also tells us that once a business is off the ground, customers will get access to the company’s software, which should allow them to schedule tutoring sessions, manage payments and invoices, give session feedback to parents through a communications tool and match with new students. Not least, Clark has a dedicated customer success team based in New York, says O’Connor, so clients have somewhere to turn.

According to Clark, the startup has so far facilitated roughly 20,000 tutoring sessions and it has hundreds of businesses across the country using its existing service. It’s because many of these clients weren’t sure how to get their businesses off the ground that Clark adopted this new model, which will also strive to connect parents with educators that match their children’s needs (parents have final say over who they ultimately hire).

Clark has raised $3.5 million to date, including from Lightspeed Venture Partners, Rethink Education, Flatworld Partners and Winklevoss Capital.

Whether its new direction speeds up its momentum remains an open question, but the company is operating in a huge market. According to some new market research on the global private tutoring opportunity, the market was valued at $96 billion in 2017, and it’s expected to generate more than $177 billion by 2026.

Source: Tech Crunch Startups | Clark, a venture-backed tutoring platform, will now help tutors build their own sites

Source: Engadget | Intel is ending development of its Compute Cards

DC Universe celebrates Batman's birthday with free access March 30th

March 22, 2019

Source: Engadget | DC Universe celebrates Batman's birthday with free access March 30th

Source: Engadget | MIT’s AI can train neural networks faster than ever before

Samsung's US marketing lead quits following department investigation

March 22, 2019

Source: Engadget | Samsung's US marketing lead quits following department investigation