It’s an ad duopoly battle. Facebook is starting to test search ads in its search results and Marketplace, directly competing with Google’s AdWords. Facebook first tried Sponsored Results back in 2012 but eventually shut down the product in 2013. Now it’s going to let a small set of automotive, retail and e-commerce industry advertisers show users ads on the search results page on mobile in the U.S. and Canada.

They’ll be repurposed News Feed ads featuring a headline, image, copy text and a link in the static image or carousel format that can point users to external websites. Facebook declined to share screenshots as it says the exact design is still evolving. Facebook may expand search ads to more countries based on the test’s performance.

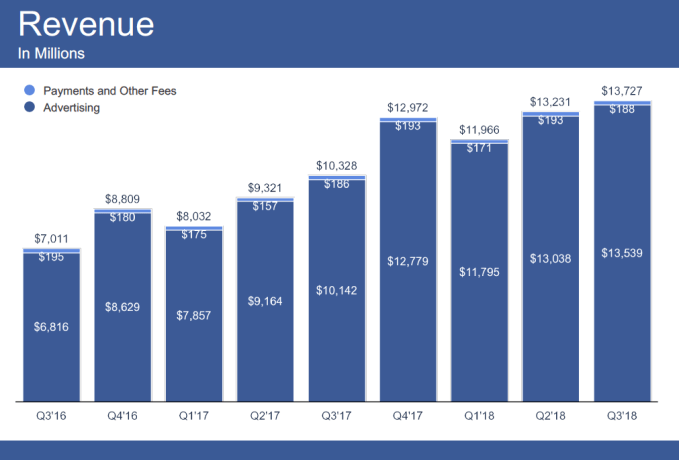

The reintroduction of search ads could open an important new revenue stream at a time when Facebook’s revenue growth is quickly decelerating as it runs out of News Feed ad space, the Stories format that advertisers are still adapting is poised to overtake feed sharing on social apps and users shift their time elsewhere. In Q3 2018, revenue grew 33 percent year-over-year, but that’s far slower than the 49 percent YOY gain it had a year ago, and the 59 percent from Q3 2016. While 33 percent is still relatively swift for a 14-year-old company and Facebook is far from in existential crisis, the revenue growth rate has been the focus of this year’s earnings calls and sagging projections about it have caused massive slides in Facebook’s share price.

Opening up new ad inventory for search could reinvigorate the sagging revenue growth rate that, combined with Facebook’s privacy and security scandals, has put intense pressure on Facebook’s leaders Mark Zuckerberg and Sheryl Sandberg.

Facebook’s revenue growth rate has slowed significantly over the past two years

“We’re running a small test to place ads in Facebook search results, and we’ll be evaluating whether these ads are beneficial for people and businesses before deciding whether to expand it,” Facebook product manager Zoheb Hajiyani told TechCrunch in a statement. The announcement of the search ads comes as Google’s CEO Sundar Pichai is under fire from Congress over data privacy, though the move could help Google look less like it has a monopoly in search.

Back in 2012, Facebook desperately sought extra revenue streams following its botched IPO. Sponsored Results let game companies, retailers and more inject links to their Facebook apps, Pages and posts as ads in the search type-ahead results. Since advertisers could target searches for specific other Pages and apps, brands and game developers often tried to swoop in and steal traffic from their competitors. For example, dating app Match.com could target searches for competitor OkCupid and appear above its results. Facebook isn’t allowing advertisers to be quite as cutthroat with this test.

Facebook’s 2012 Sponsored Results ads let competitors swoop on each other’s traffic

With the relaunch, advertisers with access will be able to simply extend their existing News Feed ads to the new “Search” placement through the Facebook Ads Manager, similar to how they’d pick Facebook Audience Network or Instagram. No video ads will be allowed, and search ads won’t appear on desktop. Marketplace search ads will appear on iOS and Android, while Facebook search ads are only testing on Android. For now, advertisers won’t pick specific keywords to advertise against, and instead may appear in search terms related to auto or retail topics. Still, the placement will let advertisers dive deeper down the conversion funnel to reach people who might already have intent to buy something and fulfill that demand. Facebook’s News Feed ads (other than those retargeted based on web browsing) are better for demand generation, and sit higher in the funnel reaching users who don’t know what they want yet.

Ads will feature a “Sponsored” tag, and are subject to the same transparency controls around “Why Am I Seeing This?” Facebook plans to evaluate the benefits for users and advertisers in order to determine whether to roll out the ads to more countries and categories. Users will not be able to opt out of seeing search ads. They can “hide” ads using the drop-down arrow as with News Feed ads, but that won’t prevent different ones from showing up in search later.

Facebook’s share of the $279.56 billion total worldwide digital ad market will grow to 19.5 percent this year, trailing No. 1 Google, which has 31.5 percent. After gaining multiple percentage points of share the last few years, eMarketer estimated Facebook’s cut of total digital ad spend would fall to around 1 percent the next two years. Unlocking search ad inventory could perk up those projections. Facebook would only need to hit 3.3 percent of total search ad share to surpass Microsoft for the No. 3 spot, or 6.5 percent to top Chinese search engine Baidu.

One major concern is that Facebook already collects as much information as possible about people and their behavior to target its ads. With the reintroduction of search ads, it’s even more incentivized to gather what we do online, what we buy offline and who we are.

Facebook will have to balance the injection of the ads with remaining an easy way to search for friends, content, businesses and more. Search is far from the core of Facebook’s offering, where users typically browse the News Feed for serendipitous content discovery rather than go looking for something specific. The most common searches are likely for friends’ names which won’t be great ad candidates. But given how accustomed users are to search ads on Google, this new revenue stream could help Facebook boost its numbers without too much disruption to its service.

[Updated with context on Facebook’s revenue growth rate]

Source: Tech Crunch Mobiles | Facebook relaunches search ads to offset slowing revenue

No Comments