Novameat, a Spanish startup looking to accelerate the development of alternative proteins across the meat aisle, has gotten a boost in the form of new investment capital from the leading foodtech investment firm, New Crop Capital.

Founded by biomedical engineering expert Giuseppe Scionti, Novameat builds on Scionti’s decade of research as an assistant professor in bioengineering at the Polytechnic University of Catalonia, the University College of London, Chalmers University and Polytechnic University of Milan.

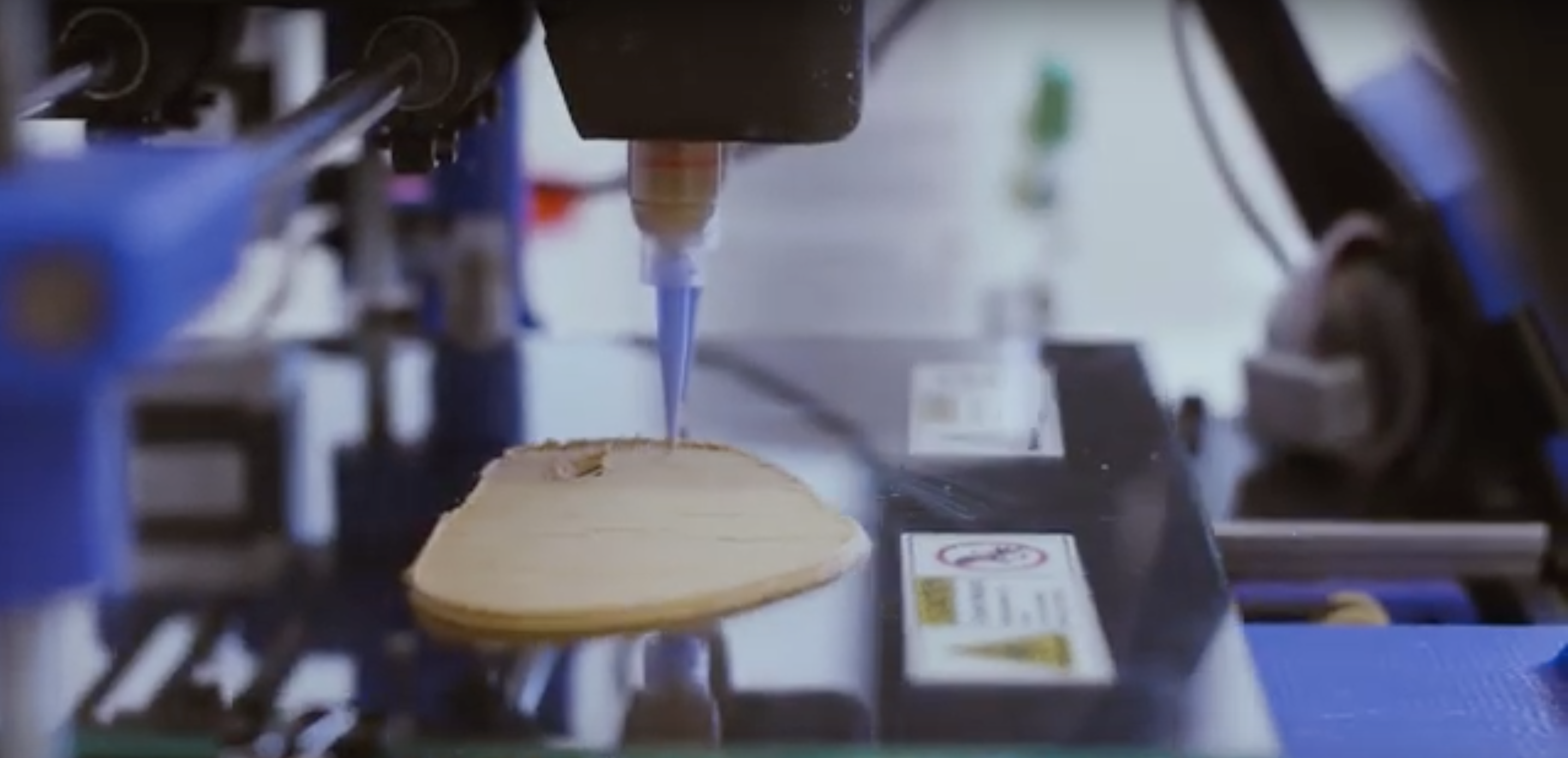

The company first came to fame with the production of the world’s first 3D-printed plant-based beefsteak in 2018 and will use the new funds from New Crop Capital to further develop its platform for accelerating the development of meats like steak, chicken breasts and other fibrous textured meat replacements.

The company has developed a new scaffolding technology that mimics the texture, appearance, nutritional and sensorial properties of fibrous meats like beefsteaks, chicken breasts and fish filets.

Scionti sees the technology as the next step in the development of plant-based and lab-cultured alternatives to traditional proteins. While many clean meat and plant-based food companies have managed to take ground meat replacements to market with similar taste and textural qualities to the real thing, steaks and cuts of muscle meat have proven harder to replicate.

Novameat potentially solves that problem.

“While I was researching on regenerating animal tissues through bioprinting technologies for biomedical and veterinary applications, I discovered a way to bio-hack the structure of the native 3D matrix of a variety of plant-based proteins to achieve a meaty texture,” said Scionti, in a statement.

The core of Novameat’s technology is a customized printer that enables companies to create the kinds of fibrous tissues needed to make a steak. “We are providing the equipment, the machinery, under a licensing agreement to these companies,” says Scionti. “Plant-based meat manufacturers have access to something that creates the texture and taste of a steak.”

Traditional extrusion technologies are not capable of using the ingredients from Beyond Meat or Impossible Foods to print a steak, but Novameat’s founder argues that his technology can.

The technology was promising enough to attract the attention of New Crop Capital, arguably one of the most seasoned investors in the expanding market of meat replacement. The venture firm’s portfolio includes Memphis Meat, Beyond Meat, Kite Hill, Geltor, Good Dot, Aleph Farms, Supermeat, Mosa Meat, New Wave and Zero Egg.

“We think the global food supply chain is broken and we are focused on fixing one of those challenges, which is animal protein,” says New Crop Capital’s Dan Altschuler Malek. “We see that there is an opportunity to shift consumer behavior to reduce their consumption of animal protein products to products that are at the price point that people will pay.”

Novameat can help reduce costs, Malek thinks, because it speeds up the time to create meat substitutes.

Scionti says the company’s micro-extrusion technology enables companies to get a three-dimensional structure without having to go through an incubation period that can take a significant amount of time and increase costs.

“Novameat’s bioprinting-based technology provides a flexible and tunable method of producing plant-based meat, with the utility to create different textures from a wide variety of ingredients, all within a single piece of meat,” he said. “Low and high-moisture extruders are the primary method currently used to restructure plant proteins to create the texture of meat. While extrusion works well for some applications, this method may not be ideal for mimicking all types of animal meat. Alternative technologies like Novameat’s give plant-based meat manufacturers a wider array of tools to mimic all types of meat and seafood,” said Good Food Institute Director of Science and Technology David Welch, in a statement.

Source: Tech Crunch Startups | Novameat has a platform for 3D-printing steaks and has new money to take it to market