Factories and warehouses have been two of the biggest markets for robots in the last several years, with machines taking on mundane, if limited, processes to speed up work and free up humans to do other, more complex tasks. Now, a startup out of Poland that is widening the scope of what those robots can do is announcing funding, a sign not just of how robotic technology has been evolving, but of the growing demand for more automation, specifically in the world of logistics and fulfilment.

Nomagic, which has developed way for a robotic arm to identify an item from an unordered selection, pick it up and then pack it into a box, is today announcing that it has raised $8.6 million in funding, one of the largest-ever seed rounds for a Polish startup. Co-led by Khosla Ventures and Hoxton Ventures, the round also included participation from DN Capital, Capnamic Ventures and Manta Ray, all previous backers of Nomagic.

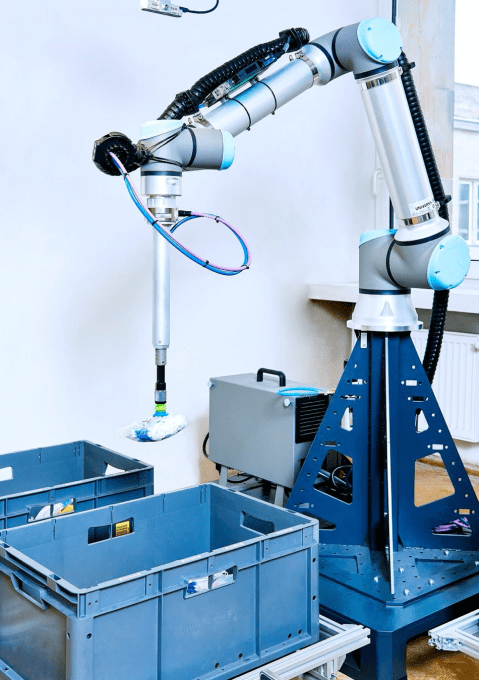

Nomagic has incorporated a new degree of computer vision, machine learning and other AI-based technologies to elevate the capabilities of those robotic arm. Robots powered by its tech can successfully select items from an “unstructured” group of objects — that is, not an assembly line, but potentially another box — before picking it up and placing it elsewhere.

Kacper Nowicki, the ex-Googler CEO of Nomagic who co-founded the company with Marek Cygan (an academic) and Tristan d’Orgeval (formerly of Climate Corporation), noted that while there has been some work on the problem of unstructured objects and industrial robots — in the US, there are some live implementations taking shape, with one, Covariant, recently exiting stealth mode — it has been mostly a “missing piece” in terms of the innovation that has been done to make logistics and fulfilment more efficient.

That is to say, there has been little in the way of bigger commercial roll outs of the technology, creating an opportunity in what is a huge market: fulfilment services are projected to be a $56 billion market by 2021 (currently the US is the biggest single region, estimated at between $13.5 billion and $15.5 billion).

“If every product were a tablet or phone, you could automate a regular robotic arm to pick and pack,” Nowicki said. “But if you have something else, say something in plastic, or a really huge diversity of products, then that is where the problems come in.”

Nowicki was a longtime Googler who moved from Silicon Valley back to Poland to build the company’s first engineering team in the country. In his years at Google, Nowicki worked in areas including Google Cloud and search, but also saw the AI developments underway at Google’s DeepMind subsidiary, and decided he wanted to tackle a new problem for his next challenge.

His interest underscores what has been something of a fork in artificial intelligence in recent years. While some of the earliest implementations of the principles of AI were indeed on robots, these days a lot of robotic hardware seems clunky and even outmoded, while much more of the focus of AI has shifted to software and “non-physical” systems aimed at replicating and improving upon human thought. Even the word “robot” is now just as likely to be seen in the phrase “robotic process automation”, which in fact has nothing to do with physical robots, but software.

“A lot of AI applications are not that appealing,” Nowicki simply noted (indeed, while Nowicki didn’t spell it out, DeepMind in particular has faced a lot of controversy over its own work in areas like healthcare). “But improvements in existing robotics systems by applying machine learning and computer vision so that they can operate in unstructured environments caught my attention. There has been so little automation actually in physical systems, and I believe it’s a place where we still will see a lot of change.”

Interestingly, while the company is focusing on hardware, it’s not actually building hardware per se, but is working on software that can run on the most popular robotic arms in the market today to make them “smarter”.

“We believe that most of the intellectual property in in AI is in the software stack, not the hardware,” said Orgeval. “We look at it as a mechatronics problem, but even there, we believe that this is mainly a software problem.”

Having Khosla as a backer is notable given that a very large part of the VC’s prolific investing has been in North America up to now. Nowicki said he had a connection to the firm by way of his time in the Bay Area, where before Google, Vinod Khosla backed a startup of his (which went bust in one of the dot-com downturns).

While there is an opportunity for Nomagic to take its idea global, for now Khosla’s interested because of the a closer opportunity at home, where Nomagic is already working with third-party logistics and fulfilment providers, as well as retailers like Cdiscount, a French Amazon-style, soup-to-nuts online marketplace.

“The Nomagic team has made significant strides since its founding in 2017,” says Sven Strohband, Managing Director of Khosla Ventures, in a statement. “There’s a massive opportunity within the European market for warehouse robotics and automation, and NoMagic is well-positioned to capture some of that market share.”

Source: Tech Crunch Startups | Nomagic, a startup out of Poland, picks up .6M for its pick-and-place warehouse robots