Quantum computing startup IonQ today announced that it has raised additional funding as part of its previously announced Series B round. This round extends the company’s funding, including its 2019 $55 million Series B round, by about $7 million and brings the total investment into IonQ to $84 million.

The new funding includes strategic investments from Lockheed Martin and Robert Bosch Venture Capital, as well as Cambium, a relatively new multi-stage VC firm that specializes in investing “in the future of computational paradigms.”

In addition to the new funding, College Park, Maryland-based IonQ also announced a number of additions to its advisory team, including 2012 Nobel Prize winner David Wineland, who worked with IonQ co-founder and chief scientist Christopher Monroe on building the first quantum logic gate back in 1995.

Other new advisors are Berkeley Quantum Computation Center co-director Umesh Vazirani, former Cray senior VP of R&D Margaret (Peg) Williams and Duke associate professor Kenneth Brown.

IonQ made an early bet on trapped ions at the core of its quantum computers, which is no surprise, given Monroe’s early work in this field.

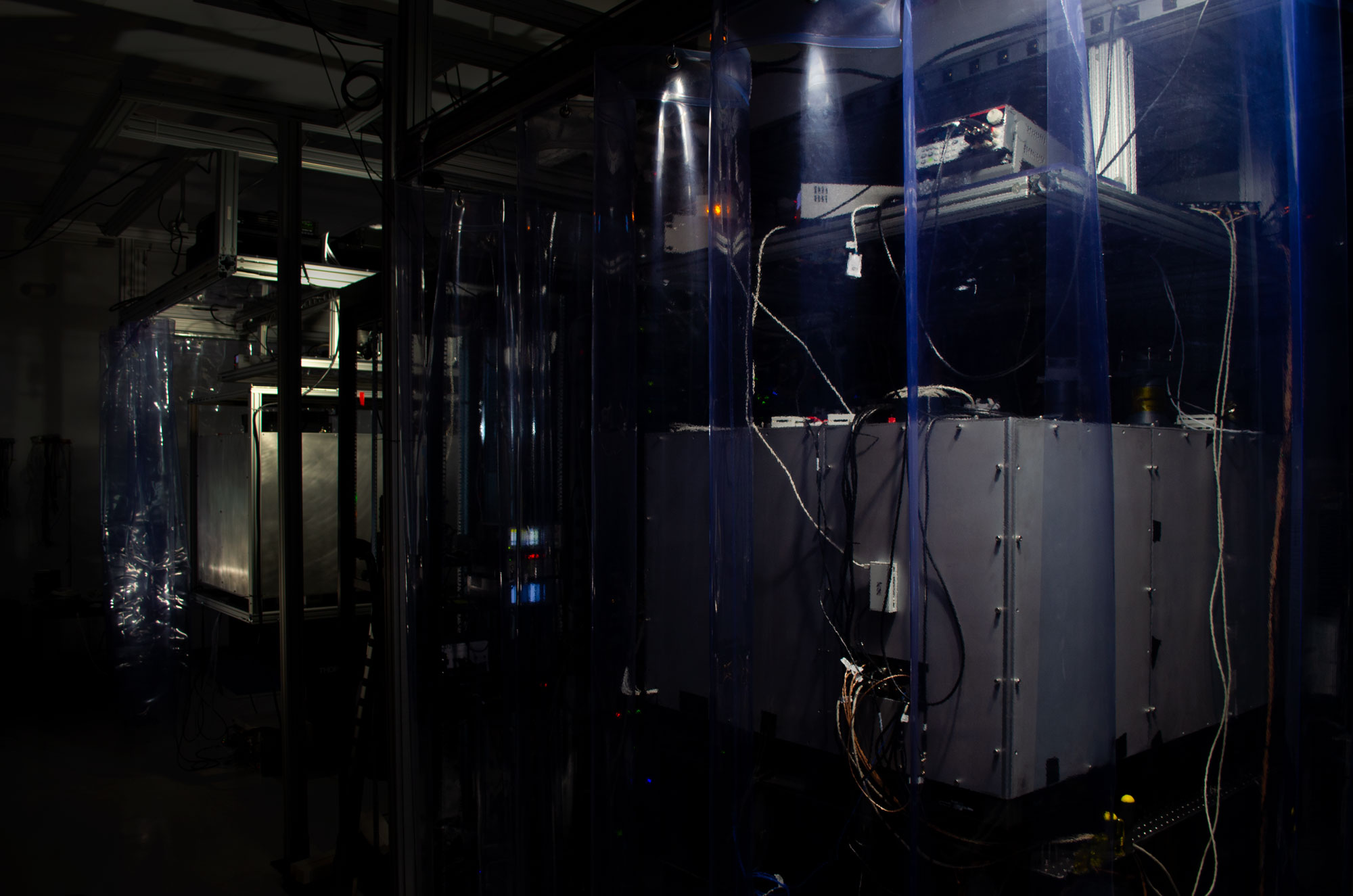

“We’re doing something which, at least initially, was thought of as kind of against the grain for quantum And what that is is trapped ion computers, which is ions which are being suspended in a vacuum and using electromagnets to hold them. So our qubits are our individual ions,” said IonQ CEO and president Peter Chapman, who was Amazon’s director of engineering for Amazon Prime before he took this new role last year. This approach has its pros and cons, Chapman explained. It makes it easier for the company to create its qubits, for example, which lets it focus on controlling them. In addition, IonQ’s machines can run at room temperature, while most of its competitors (with maybe the exception of Honeywell, which is also betting trapped ions at the core of its quantum computer) have to cool their machines to as close to zero Kelvin as possible.

One negative — at least for the time being, though — is that the trapped ion technique makes for a relatively slow quantum computer. But Chapman mostly dismissed the critique. “People say that the trapped ion computers are slow and that is true in the current generation. But slow is relative here. We run a thousand times slower or something. But at the end of the day, speed is one of those things that matters when you have two systems which can do the same thing. Then you care about the speed. If only one of the two systems can do your calculation, then it probably doesn’t matter.”

Like so many other quantum computing startups, IonQ is still mostly in its research and development phase and doesn’t currently have any revenue. That will change, though, Chapman noted, once Amazon and Microsoft start making its systems available in their clouds (something both vendors have already announced).

Until then, the new funding will go almost exclusively into R&D and Chapman noted that the team is currently working on the next three generations of its systems already.

Both Lockheed Martin and Bosch have made a number of investments in various quantum technologies and Chapman noted that Lockheed actually provided the initial grand money for IonQ co-founder Chris Monroe’s research during his time at the University of Maryland.

Source: Tech Crunch Startups | IonQ raises additional funding for its quantum computing platform