Source: Engadget | MoviePass declares bankruptcy

- The Next Century of Robo-Exoticism: In 1920, Karl Capek coined the term “robot” in a play about mechanical workers organizing a rebellion to defeat their human overlords. Join expert panelists Abigail De Kosnik (Center for New Media, University of California, Berkeley), David Ewing Duncan (Arc Fusion), Ken Goldberg (UC Berkeley College of Engineering) and Mark Pauline (Survival Research) as they discuss cultural views of robots in the context of “Robo-Exoticism,” which exaggerates both negative and positive attributes and reinforces old fears, fantasies and stereotypes.

- A Live Demo from the Stanford Robotics Club — because everybody loves to see robots in action.

- Opening the Black Box with Explainable AI: Machine learning and AI models can be found in nearly every aspect of society today, but their inner workings are often as much a mystery to their creators as to those who use them. UC Berkeley’s Trevor Darrell, Krishna Gade of Fiddler Labs and Karen Myers from SRI International will discuss what we’re doing about it and what still needs to be done.

- Strengthen security requirements for mobile network operators (e.g. strict access controls, rules on secure operation and monitoring, limitations on outsourcing of specific functions, etc.);

- Assess the risk profile of suppliers; as a consequence, apply relevant restrictions for suppliers considered to be high risk – including necessary exclusions to effectively mitigate risks – for key assets defined as critical and sensitive in the EU-wide coordinated risk assessment (e.g. core network functions, network management and orchestration functions, and access network functions);

- Ensure that each operator has an appropriate multi-vendor strategy to avoid or limit any major dependency on a single supplier (or suppliers with a similar risk profile), ensure an adequate balance of suppliers at national level and avoid dependency on suppliers considered to be high risk; this also requires avoiding any situations of lock-in with a single supplier, including by promoting greater interoperability of equipment;

Source: Engadget | KFC expands its Beyond Meat test to Charlotte and Nashville

“We’re trying to shift cryptocurrency from this speculative asset class to driving real-world utility,” Coinbase CEO Brian Armstrong tells me. How? Through commerce and micropayments. But now Coinbase has the who to build it. Today the startup announced it has hired away former head of Product for Indian e-commerce giant Flipkart and Google Shopping VP of Product Surojit Chatterjee to become Coinbase’s chief product officer.

“I’ve always enjoyed being associated with technology that is on the brink of changing how we live” writes Chatterjee. “Google ads has helped democratize commerce, Flipkart and ecommerce has revolutionized life in India, and I believe Coinbase is going to turn conventional finance on its head.”

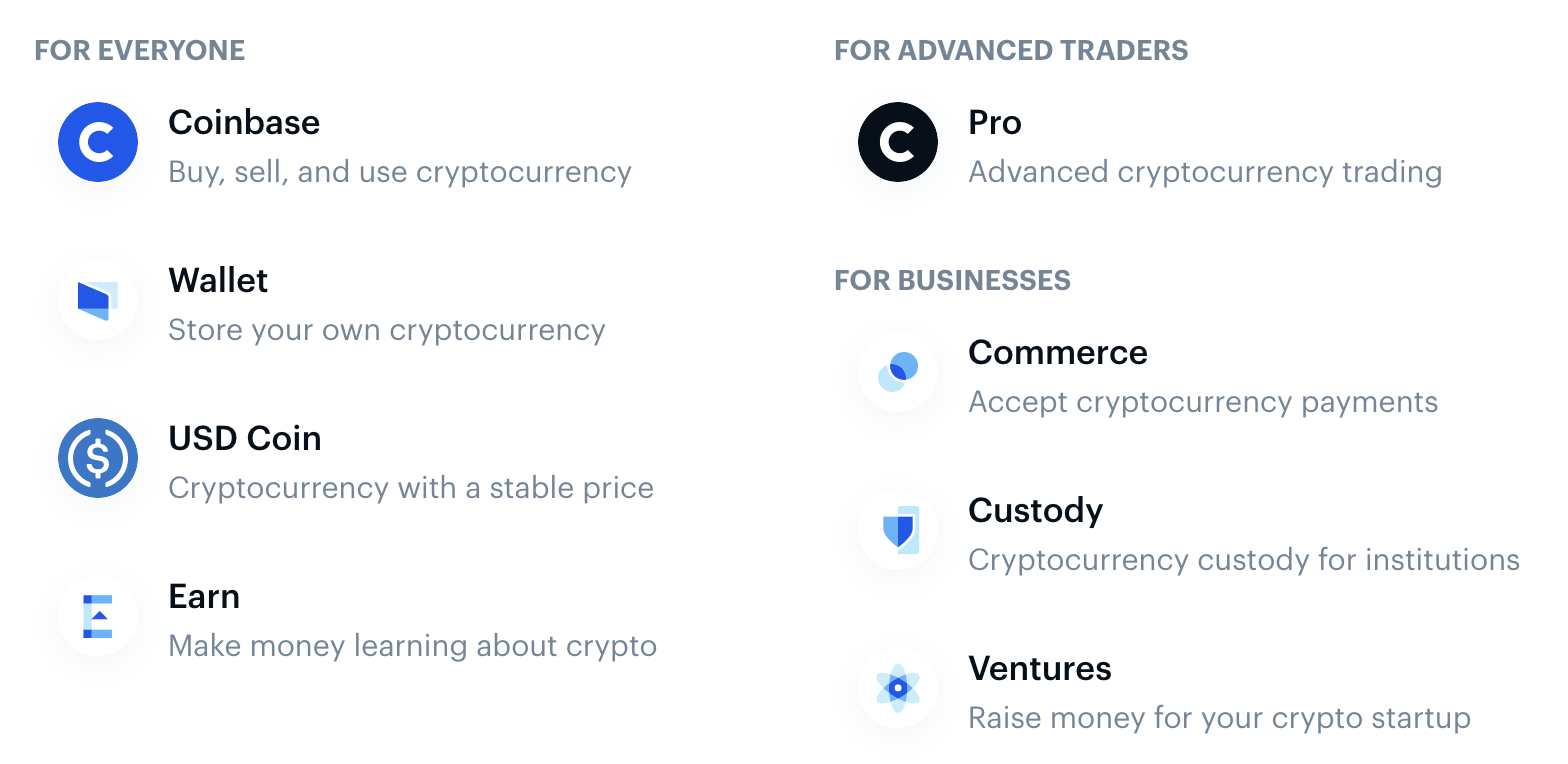

Chatterjee spent more than 11 years at Google over two stints, the first as a founding member of Google’s mobile search Ads product that’s grown to tens of billions in revenue per year. When he starts at Coinbase next week, Armstrong tells me he’ll help Coinbase organize its complex array of products, including its cryptocurrency exchange, wallet, stablecoin, incentivized crypto education platform Earn and Coinbase Commerce that lets businesses take payments in Bitcoin, Ethereum and more. Chatterjee replaces Jeremy Henrickson, the former Coinbase CPO who departed in December 2018.

“Surojit is a huge asset here because we’re a product-led company,” Armstrong says. “We have different leaders and they increasingly have responsibilities around P&L. Having one really experienced chief product officer that can mentor them and teach them to own revenues and budgets — really in the model of Google — that will professionalize Coinbase.”

One opportunity Armstrong hopes Chatterjee can help Coinbase seize on is building products for emerging markets where financial infrastructure is weak. “E-commerce is not equally distributed around the world. Micropayments don’t work that well … Him spending time living in India, a developing market, he deeply understands mobile money.” Given the explosion of phone-based payments, the demonetization and the prevalence of cash on delivery methods in India that Flipkart dealt with, “his background is kind of ideal from that worldly perspective,” Armstrong explains.

Chatterjee cites his upbringing as inspiration to deliver “economic freedom for everyone,” as Armstrong says is Coinbase’s mission. “Growing up in India in a poor middle-class household, I saw very closely what a lack of liquid cash does to a family’s lifestyle,” Chatterjee recalls.

“As a kid I would go with my mom to a local bank to withdraw money. And believe me when I tell you that the process was epic!” It included withdrawal slips, tokens and anxiously trying to match current signatures to versions decades old. When India demonetized and made everyone exchange their cash, “My dad, who was almost 80 at that time, stood in a queue for five hours to get 2000 Rs, which was the per-day limit for the first week. That’s less than $30!” Digital money could ensure people always have access to everything they own.

Surojit Chatterjee (far right) rides along for a Flipkart delivery to understand the consumer commerce experience

In developed countries, Armstrong sees a chance for Chatterjee to enable digital content creators to turn their passion into their profession. “There’s lots of people who lurk on Reddit or Stack Overflow and answer questions … If there was real money on these things, these could be their full time jobs — contributing content on user-generated social sites,” Armstrong predicts. “I think you’d see a lot more contributions, as well.”

Now might be the perfect time to hire Chatterjee since we’re in a lull period for cryptocurrency in the wake of the rush at the end of 2018. “Crypto is always challenging to navigate. In these periods when it’s relatively quiet, we tend to do really well,” Armstrong says. The company grew market share, volume and app installs versus competitors between 50% and 100%, according to the CEO. Referencing ancient war strategy, Armstrong concludes that, “There’s years where you just want to train the soldiers and stockpile resources and you’re basically just preparing. We’re building the company, not just responding to crazy hype.”

Source: Tech Crunch Startups | Coinbase poaches Google Shopping VP as CPO for cryptocommerce

“We’re trying to shift cryptocurrency from this speculative asset class to driving real-world utility,” Coinbase CEO Brian Armstrong tells me. How? Through commerce and micropayments. But now Coinbase has the who to build it. Today the startup announced it has hired away former head of Product for Indian e-commerce giant Flipkart and Google Shopping VP of Product Surojit Chatterjee to become Coinbase’s chief product officer.

“I’ve always enjoyed being associated with technology that is on the brink of changing how we live” writes Chatterjee. “Google ads has helped democratize commerce, Flipkart and ecommerce has revolutionized life in India, and I believe Coinbase is going to turn conventional finance on its head.”

Chatterjee spent more than 11 years at Google over two stints, the first as a founding member of Google’s mobile search Ads product that’s grown to tens of billions in revenue per year. When he starts at Coinbase next week, Armstrong tells me he’ll help Coinbase organize its complex array of products, including its cryptocurrency exchange, wallet, stablecoin, incentivized crypto education platform Earn and Coinbase Commerce that lets businesses take payments in Bitcoin, Ethereum and more. Chatterjee replaces Jeremy Henrickson, the former Coinbase CPO who departed in December 2018.

“Surojit is a huge asset here because we’re a product-led company,” Armstrong says. “We have different leaders and they increasingly have responsibilities around P&L. Having one really experienced chief product officer that can mentor them and teach them to own revenues and budgets — really in the model of Google — that will professionalize Coinbase.”

One opportunity Armstrong hopes Chatterjee can help Coinbase seize on is building products for emerging markets where financial infrastructure is weak. “E-commerce is not equally distributed around the world. Micropayments don’t work that well … Him spending time living in India, a developing market, he deeply understands mobile money.” Given the explosion of phone-based payments, the demonetization and the prevalence of cash on delivery methods in India that Flipkart dealt with, “his background is kind of ideal from that worldly perspective,” Armstrong explains.

Chatterjee cites his upbringing as inspiration to deliver “economic freedom for everyone,” as Armstrong says is Coinbase’s mission. “Growing up in India in a poor middle-class household, I saw very closely what a lack of liquid cash does to a family’s lifestyle,” Chatterjee recalls.

“As a kid I would go with my mom to a local bank to withdraw money. And believe me when I tell you that the process was epic!” It included withdrawal slips, tokens and anxiously trying to match current signatures to versions decades old. When India demonetized and made everyone exchange their cash, “My dad, who was almost 80 at that time, stood in a queue for five hours to get 2000 Rs, which was the per-day limit for the first week. That’s less than $30!” Digital money could ensure people always have access to everything they own.

Surojit Chatterjee (far right) rides along for a Flipkart delivery to understand the consumer commerce experience

In developed countries, Armstrong sees a chance for Chatterjee to enable digital content creators to turn their passion into their profession. “There’s lots of people who lurk on Reddit or Stack Overflow and answer questions … If there was real money on these things, these could be their full time jobs — contributing content on user-generated social sites,” Armstrong predicts. “I think you’d see a lot more contributions, as well.”

Now might be the perfect time to hire Chatterjee since we’re in a lull period for cryptocurrency in the wake of the rush at the end of 2018. “Crypto is always challenging to navigate. In these periods when it’s relatively quiet, we tend to do really well,” Armstrong says. The company grew market share, volume and app installs versus competitors between 50% and 100%, according to the CEO. Referencing ancient war strategy, Armstrong concludes that, “There’s years where you just want to train the soldiers and stockpile resources and you’re basically just preparing. We’re building the company, not just responding to crazy hype.”

Source: Tech Crunch Mobiles | Coinbase poaches Google Shopping VP as CPO for cryptocommerce

Just two days stand between you and serious savings on tickets to TC Sessions: Robotics + AI 2020. This annual day-long event draws the most innovative and visionary technologists, researchers and investors from two game-changing industries — last year we hosted 1,500 attendees. Make a smart investment. Buy an early-bird ticket before prices go up on January 31 and save $150.

Looking for exposure? We have two fantastic ways to put your early-stage startup in front of a highly influential group of VCs and technologists. Check this out.

Apply to compete in Pitch Night. Ten startups will compete in a mini pitch-off at a private event the night before the conference. A panel of VC judges will choose five finalists to pitch again the next day from the TC Sessions Main Stage. All 10 teams will each receive two free tickets to the event. Submit your application here by February 1. We’ll notify selected startups by February 15.

Buy a Startup Exhibitor Package and demo at the event. You’d better jump on this opportunity, and fast — we have only two packages left. The $2,200 price includes four tickets to the event. Bring your crew and quadruple your networking potential.

Now let’s talk about the kind of programming you can expect. We’re talking a full day of presentations, panel discussions, world-class speakers, workshops, robot demos and plenty of time for networking. Here’s a sample of what’s on tap (you can check out the day’s agenda here):

TC Sessions: Robotics + AI 2020 takes place on March 3, but early-bird tickets disappear in just two days. Remember the deadline: January 31. Get the most out of your startup dollars — buy a ticket now and save $150.

Is your company interested in sponsoring or exhibiting at TC Sessions: Robotics + AI 2020? Contact our sponsorship sales team by filling out this form.

( function() {

var func = function() {

var iframe = document.getElementById(‘wpcom-iframe-a4fad19c68e846fecc75f11477e3b068’)

if ( iframe ) {

iframe.onload = function() {

iframe.contentWindow.postMessage( {

‘msg_type’: ‘poll_size’,

‘frame_id’: ‘wpcom-iframe-a4fad19c68e846fecc75f11477e3b068’

}, “https://tcprotectedembed.com” );

}

}

// Autosize iframe

var funcSizeResponse = function( e ) {

var origin = document.createElement( ‘a’ );

origin.href = e.origin;

// Verify message origin

if ( ‘tcprotectedembed.com’ !== origin.host )

return;

// Verify message is in a format we expect

if ( ‘object’ !== typeof e.data || undefined === e.data.msg_type )

return;

switch ( e.data.msg_type ) {

case ‘poll_size:response’:

var iframe = document.getElementById( e.data._request.frame_id );

if ( iframe && ” === iframe.width )

iframe.width = ‘100%’;

if ( iframe && ” === iframe.height )

iframe.height = parseInt( e.data.height );

return;

default:

return;

}

}

if ( ‘function’ === typeof window.addEventListener ) {

window.addEventListener( ‘message’, funcSizeResponse, false );

} else if ( ‘function’ === typeof window.attachEvent ) {

window.attachEvent( ‘onmessage’, funcSizeResponse );

}

}

if (document.readyState === ‘complete’) { func.apply(); /* compat for infinite scroll */ }

else if ( document.addEventListener ) { document.addEventListener( ‘DOMContentLoaded’, func, false ); }

else if ( document.attachEvent ) { document.attachEvent( ‘onreadystatechange’, func ); }

} )();

Source: Tech Crunch Startups | 48 hours left on early-bird pricing to TC Sessions: Robotics + AI 2020

Greylock’s Reid Hoffman and Sarah Guo to talk fundraising at Early Stage SF 2020

January 29, 2020Early Stage SF is around the corner, on April 28 in San Francisco, and we are more than excited for this brand new event. The intimate gathering of founders, VCs, operators and tech industry experts is all about giving founders the tools they need to find success, no matter the challenge ahead of them.

Struggling to understand the legal aspects of running a company, like negotiating cap tables or hiring international talent? We’ve got breakout sessions for that. Wondering how to go about fundraising, from getting your first yes to identifying the right investors to planning the timeline for your fundraise sprint? We’ve got breakout sessions for that. Growth marketing? PR/Media? Building a tech stack? Recruiting?

We. Got. You.

Hoffman + Guo

Today, we’re very proud to announce one of our few Main Stage sessions that will be open to all attendees. Reid Hoffman and Sarah Guo will join us for a conversation around “How To Raise Your Series A.”

Reid Hoffman is a legendary entrepreneur and investor in Silicon Valley. He was an Executive VP and founding board member at PayPal before going on to co-found LinkedIn in 2003. He led the company to profitability as CEO before joining Greylock in 2009. He serves on the boards of Airbnb, Apollo Fusion, Aurora, Coda, Convoy, Entrepreneur First, Microsoft, Nauto and Xapo, among others. He’s also an accomplished author, with books like “Blitzscaling,” “The Startup of You” and “The Alliance.”

Sarah Guo has a wealth of experience in the tech world. She started her career in high school at a tech firm founded by her parents, called Casa Systems. She then joined Goldman Sachs, where she invested in growth-stage tech startups such as Zynga and Dropbox, and advised both pre-IPO companies (Workday) and publicly traded firms (Zynga, Netflix and Nvidia). She joined Greylock Partners in 2013 and led the firm’s investment in Cleo, Demisto, Sqreen and Utmost. She has a particular focus on B2B applications, as well as infrastructure, cybersecurity, collaboration tools, AI and healthcare.

The format for Hoffman and Guo’s Main Stage chat will be familiar to folks who have followed the investors. It will be an updated, in-person combination of Hoffman’s famously annotated LinkedIn Series B pitch deck that led to Greylock’s investment, and Sarah Guo’s in-depth breakdown of what she looks for in a pitch.

They’ll lay out a number of universally applicable lessons that folks seeking Series A funding can learn from, tackling each from their own unique perspectives. Hoffman has years of experience in consumer-focused companies, with a special expertise in network effects. Guo is one of the top minds when it comes to investment in enterprise software.

We’re absolutely thrilled about this conversation, and to be honest, the entire Early Stage agenda.

How it works

Here’s how it all works:

There will be about 50+ breakout sessions at the event, and attendees will have an opportunity to attend at least seven. The sessions will cover all the core topics confronting early-stage founders — up through Series A — as they build a company, from raising capital to building a team to growth. Each breakout session will be led by notables in the startup world.

Don’t worry about missing a breakout session, because transcripts from each will be available to show attendees. And most of the folks leading the breakout sessions have agreed to hang at the show for at least half the day and participate in CrunchMatch, TechCrunch’s app to connect founders and investors based on shared interests.

Here’s the fine print. Each of the 50+ breakout sessions is limited to around 100 attendees. We expect a lot more attendees, of course, so signups for each session are on a first-come, first-serve basis. Buy your ticket today and you can sign up for the breakouts that we’ve announced. Pass holders will also receive 24-hour advance notice before we announce the next batch. (And yes, you can “drop” a breakout session in favor of a new one, in the event there is a schedule conflict.)

Grab yourself a ticket and start registering for sessions right here. Interested sponsors can hit up the team here.

( function() {

var func = function() {

var iframe = document.getElementById(‘wpcom-iframe-02477ba73f2ce7104ba54bd838810d2a’)

if ( iframe ) {

iframe.onload = function() {

iframe.contentWindow.postMessage( {

‘msg_type’: ‘poll_size’,

‘frame_id’: ‘wpcom-iframe-02477ba73f2ce7104ba54bd838810d2a’

}, “https://tcprotectedembed.com” );

}

}

// Autosize iframe

var funcSizeResponse = function( e ) {

var origin = document.createElement( ‘a’ );

origin.href = e.origin;

// Verify message origin

if ( ‘tcprotectedembed.com’ !== origin.host )

return;

// Verify message is in a format we expect

if ( ‘object’ !== typeof e.data || undefined === e.data.msg_type )

return;

switch ( e.data.msg_type ) {

case ‘poll_size:response’:

var iframe = document.getElementById( e.data._request.frame_id );

if ( iframe && ” === iframe.width )

iframe.width = ‘100%’;

if ( iframe && ” === iframe.height )

iframe.height = parseInt( e.data.height );

return;

default:

return;

}

}

if ( ‘function’ === typeof window.addEventListener ) {

window.addEventListener( ‘message’, funcSizeResponse, false );

} else if ( ‘function’ === typeof window.attachEvent ) {

window.attachEvent( ‘onmessage’, funcSizeResponse );

}

}

if (document.readyState === ‘complete’) { func.apply(); /* compat for infinite scroll */ }

else if ( document.addEventListener ) { document.addEventListener( ‘DOMContentLoaded’, func, false ); }

else if ( document.attachEvent ) { document.attachEvent( ‘onreadystatechange’, func ); }

} )();

Source: Tech Crunch Startups | Greylock’s Reid Hoffman and Sarah Guo to talk fundraising at Early Stage SF 2020

Insurance startup Gabi raises $27M to double its product, engineering and marketing teams

January 29, 2020Gabi, a startup built to help consumers save money on home and auto insurance, announced today that it has closed a $27 million Series B.

The company intends to use its new capital to rapidly expand its team and invest in its product. Nearly every startup does something similar after it collects new cash, so what makes Gabi’s round interesting? Its space is attracting lots of capital, it has some notable, venture-backed competitors and its business model helped the company close its latest round. All that made the Gabi deal quite interesting.

TechCrunch covered the company’s Series A back in early 2018. The startup has come quite a ways since then. Let’s dig in.

The basics

Before the company’s Series B, Gabi raised a $2.6 million seed round. That 2017-era investment came from SV Angel and A.Capital Ventures. Then, in early 2018, Gabi put together $9.5 million in a Series A led by Canvas Ventures. As you can quickly see, the company’s latest round is larger than its preceding capital raises times two.

That makes the $27 million round a big deal for the young company. Mubadala Capital led the event, while prior investors Canvas and others took part. Gabi has now raised $39.1 million in known capital.

Finally, before we dig into Gabi, how it works and why that matters, it’s worth noting that the company declined to share any growth metrics. We’d normally complain at this juncture, but its competitor Insurify — which raised a $23 million Series A earlier this year — also didn’t share notes on its own growth. Given that they are both now well-funded, we won’t let them not share in the future.

Now let’s tie the company’s model to its round.

How Gabi works

TechCrunch previously explored the company’s creation and operational history, which lets us instead focus on what it does today. Gabi is what CEO Hanno Fichtner calls a “tech-enabled broker,” sitting between customers and insurance companies. Its service lets people upload their current policy, which Gabi uses to find cheaper policies for the customer that have similar levels of coverage.

If that customer buys a new policy, Gabi gets paid. However, there’s a wrinkle. According to Fichtner, Gabi gets paid again if that customer renews the policy. So, in a sense, Gabi generates recurring revenue. And the better it does at matching consumers with insurance that they buy, and then keep, the more money it can make. (This impact is heightened by the fact that most Gabi customers are existing insurance customers, it told TechCrunch, meaning that they tend to make for more lucrative sign-ups.)

All that fits into the Series B when you consider time. Gabi is around three years old, Fichtner told TechCrunch, meaning that its early customer cohorts have only had so much time to mature, and demonstrate retention (renewals); the higher the company’s retention rates proved to be, the more lifetime value (LTV) that Gabi could squeeze from its customers.

More simply, the better its retention proved, the more valuable Gabi would be as a business. Which brings us back to its new round.

Gabi raised its Series B, from which we can infer that its retention rates were at least pretty good. The company thinks so. Fichtner told TechCrunch that Gabi was able to raise because its “unit economics are so great.” The CEO went on to say that Gabi has “proven in the past year that customers like our product, that they are signing up at reasonable customer acquisition costs (CAC) and that the lifetime value (LTV) that we are producing based on retention [is] high enough” to be attractive.

So, getting paid off consumer insurance re-ups seems to have made Gabi an attractive receptacle for venture dollars.

The insurance game

According to Fichtner, Gabi works with a number of the venture-backed insurance companies — startups like Root Insurance and Lemonade. Regular readers will recall that we’ve inducted two of the three into the $100 million ARR club (more here and here). Fichtner told TechCrunch that they make attractive partners as they are “quite competitive” and provide strong customer support.

Toss in Insurify and Gabi and there’s a constellation of insurance-focused startups that are raising oodles of ducats. Why? Fichtner left us with a figure that we have to share as it helps answer our question. Guess, if you will, how much money is paid out in the U.S. each year in insurance commissions? $64 billion, for personal (non-corporate) insurance.

According to the executive, commissions on such products can be as high as 13%. You can do the math. That’s one heck of a lot of space to sell into.

Source: Tech Crunch Startups | Insurance startup Gabi raises M to double its product, engineering and marketing teams

The European Commission has endorsed a risk mitigation approach to managing 5G rollouts across the bloc — meaning there will be no pan-EU ban on Huawei. Rather it’s calling for Member States to coordinate and implement a package of “mitigating measures” in a 5G toolbox it announced last October and has endorsed today.

“Through the toolbox, the Member States are committing to move forward in a joint manner based on an objective assessment of identified risks and proportionate mitigating measures,” it writes in a press release.

It adds that Member States have agreed to “strengthen security requirements, to assess the risk profiles of suppliers, to apply relevant restrictions for suppliers considered to be high risk including necessary exclusions for key assets considered as critical and sensitive (such as the core network functions), and to have strategies in place to ensure the diversification of vendors”.

The move is another blow for the Trump administration — after the UK government announced yesterday that it would not be banning so-called “high risk” providers from supplying 5G networks.

Instead the UK said it will place restrictions on such suppliers — barring their kit from the “sensitive” ‘core’ of 5G networks, as well as from certain strategic sites (such as military locations), and placing a 35% cap on such kit supplying the access network.

However the US has been amping up pressure on the international community to shut the door entirely on the Chinese tech giant, claiming there’s inherent strategic risk in allowing Huawei to be involved in supplying such critical infrastructure — with the Trump administration seeking to demolish trust in Chinese-made technology.

Next-gen 5G is expected to support a new breed of responsive applications — such as self-driving cars and personalized telemedicine — where risks, should there be any network failure, are likely to scale too.

But the Commission take the view that such risks can be collectively managed.

The approach to 5G security continues to leave decisions on “specific security” measures as the responsibility of Member States. So there’s a possibility of individual countries making their own decisions to shut out Huawei. But in Europe the momentum appears to be against such moves.

“The collective work on the toolbox demonstrates a strong determination to jointly respond to the security challenges of 5G networks,” the EU writes. “This is essential for a successful and credible EU approach to 5G security and to ensure the continued openness of the internal market provided risk-based EU security requirements are respected.”

The next deadline for the 5G toolbox is April 2020, when the Commission expects Member States to have implemented the recommended measures. A joint report on their implementation will follow later this year.

Key actions being endorsed in the toolbox include:

The Commission also recommends that Member States should contribute towards increasing diversification and sustainability in the 5G supply chain and co-ordinate on standardization around security objectives and on developing EU-wide certification schemes.

Source: Tech Crunch Mobiles | No pan-EU Huawei ban as Commission endorses 5G risk mitigation plan

In the streaming era, data on a show’s viewership and popularity is harder to come by. It’s no longer as simple as setting up a Nielsen box to get data on a show being watched across TVs, phones, tablets and the web. One company solving this problem for content owners, broadcasters and streamers alike is Whip Media Group, parent company to the TV and movie tracking app TV Time. The company announced today it has raised $50 million in Series D funding to continue to grow its business.

The round was led by asset management firm Eminence Capital and includes participation from Raine Ventures. To date, Whip Media Group has raised $115 million from Raine Ventures, Eminence, IVP and others.

Whip Media Group has a varied history. TV Time began as WhipClip, a source for a legal collection of GIFs from favorite shows. But following the company’s acquisition of French startup TVShow Time in December 2016, it pivoted to become a social TV community. The TV Time app allows users to track their favorite shows by marking episodes as watched, as well as join in the show’s community on the app where users discuss the episode; share photos, screencaps, and memes; take polls; and more. Its recommendations feature also helps users find more things to watch.

The company rebranded as Whip Media Group to reflect that it’s now home to a handful of businesses, including the TV Time app, as well as TheTVDB, an entertainment database for TV and movies and, more recently, the content value management platform, Mediamorph.

Though consumers only interact with the TV Time app, those engagements help fuel Whip Media Group’s larger business.

Today, the TV Time app has anywhere between 800,000 and a million active users per day. And 50% of users contribute some sort of data — for example, following a show, creating content, liking another user’s post, reviewing an episode, commenting and so on. To date, TV Time has tracked more than 15 billion episodes.

Initially, TV Time was using this data to develop a new type of ratings system for the cord-cutting era. But TV Time learned that a show’s ratings don’t matter to video-on-demand services that don’t sell advertising. Instead, what TV Time could provide was emotional data on how users responded to shows.

“By collecting [this data] we can build these models to not only say what people are watching, but also start to predict what they’re going to watch next,” says Whip Media Group CEO Richard Rosenblatt.

In addition, the engagement data can help streamers find out things they never could before — like which moment in an episode had huge spikes of user interest, i.e. “the most memed moment.” This data can help them to better market the show as well as help them think about the show’s direction for future seasons.

This data is highly valuable to Whip Media Group’s clients, which include more than 50 of the biggest names in entertainment — like Disney, Warner Bros., Hulu, NBCU, Paramount, Sony, Lionsgate, BBC, HBO, AT&T, T-Mobile, Liberty Global, Discovery and United Talent Agency. (There are other large, household names in streaming that also use the company’s data, but can’t be disclosed due to NDAs.)

When a content owner sells a show to a modern-day streaming service, they often have no way of knowing how it performs.

Whip Media Group, starting at the end of Q1, will be able to start making predictions about where a particular piece of content available for sale should go, says Rosenblatt.

“We will be able to roll out, starting in the first quarter, an ‘engagement score,’ where [content owners will] actually be able to look at how one piece of content engages a certain demographic or a certain geography differently than another piece of content,” Rosenblatt explains. “If you think about how ad networks got started 20 years ago — and you were trying to match the right consumer with the right ad, and all that mattered was if they clicked. Nothing else mattered. Google won because they had the best data, the best models…that’s what we want to do,” he continues.

“We want to put the right piece of content on the right platform, in the right country, to the right demographic. And we don’t think that there’s anyone else in this position like we are — that has all of that between Mediamorph and TV Time,” he says.

This data is more important than ever in an era where core classics are selling for as much as half a billion (like the “Seinfeld” sale to Netflix or “Friends” to HBO Max) or even more (like the billion-plus-dollar deal for “Big Bang Theory,” which also went to HBO Max.)

More broadly, global online television episode and movie revenues will reach $159 billion in 2024; more than double the $68 billion recorded in 2018, according to Research and Markets.

Whip Media Group’s new round of funding is being used, in part, to help pay for the Mediamorph acquisition, which was a combination of cash and stock. But the majority is being used to grow the business, including by expanding the company’s sales and data teams and accelerating product development.

The company has already hired 20 people so far and expects to hire 50 by year-end, mostly on the data and engineering sides.

“Whip Media Group is building software and data solutions that will transform the way content is being bought and sold throughout the global entertainment ecosystem,” said Ricky Sandler, chief executive officer of Eminence Capital, in a statement. “We believe in their vision and their exceptional leadership and technology teams and are excited to partner with them as they rapidly expand their business.”

Source: Tech Crunch Startups | Whip Media Group, parent to TV show tracking app TV Time, raises M

Last year, when co-founders Danny Steiner and Krista Berlincourt debuted Kenshō Health, their directory and information service for holistic medicine, Berlincourt called it “the antithesis of Goop.”

While Gwyneth Paltrow’s lifestyle brand startup serves up a heady mix of unverified pseudo-scientific claims alongside longstanding holistic practices, Steiner and Berlincourt focused on the verified and verifiable claims coming out of the medical community.

The two founders and their Los Angeles-based team amassed a group of healthcare providers hailing from Stanford University, Harvard University, Columbia University and others — all with a concentration on accreditation.

Now the service is publicly available and serving up the latest information on holistic medicine — powered by a partnership with the academic publisher Wiley — and a verified list of local practitioners for consumers seeking treatments.

“We have six points of verification,” says Steiner. “We look at accreditation, experience, peer reviews, customer reviews, we speak to the providers themselves to make sure we’re on the same page of what we’re trying to provide and for premier providers we do a background check.”

That vetting has gone a long way toward providing what the company’s founders say are tens of thousands of beta users with a search and discovery tool for information on holistic health and wellness and direct access to holistic health practitioners.

While “wellness” is a nebulous term often representing therapies with questionable clinical value, it’s a huge business in the U.S. and around the world. Some estimates from industry organizations like the Global Wellness Institute put the dollar value of the industry at roughly $4.2 trillion, encompassing everything from medical tourism to personalized and complementary medicine.

The complementary medicine component alone is a $360 billion market opportunity, according to the GWI, and it’s there that Berlincourt and Steiner are focusing their attention.

Kenshō Health co-founders Danny Steiner and Krista Berlincourt

“We wanted to create something that acted at the right point of intervention,” says Berlincourt, a former public relations professional who launched the business after turning to holistic medicine to treat her chronic adrenal failure. “So we curated a provider network and made [complementary medicine] easy to understand through research.”

The company encourages providers on its platform to offer their services on a sliding scale to improve accessibility and ensure that “this isn’t only for the wealthy elite,” says Berlincourt.

While the service is currently free, both Berlincourt and Steiner say there are obvious paths to making money that the company will explore after it builds out a solid base of users. Various potential revenue streams involve selling treatment or instructional packages or charging for listings on the site.

Kenshō’s thesis on a broader market embracing the principles of holistic medicine seems to be supported by recent moves from the nation’s largest public healthcare providers. For the first time, Medicare and Medicaid are now officially covering acupuncture as a verified treatment option for certain conditions, the Center for Medicare and Medicaid Services announced last week.

There’s also a broader recognition of the role that lifestyle and general health and fitness play in most illnesses, says Berlincourt.

“Eighty-seven percent of deaths are related to lifestyle-related disease according to the CDC,” she says. “And 75% of what we’re spending on healthcare is on the conditions associated with these chronic diseases. We don’t treat the root cause and people don’t know that there are other options.”

Now, with the public launch and financial support for investors like CrossCut Ventures, Female Founders Fund and Evolve Ventures, the company is hoping to create the “Good Housekeeping seal of approval” for wellness providers, according to Berlincourt.

“Conventional medicine wants to play with holistic medicine, but there’s a lack of connection. Our goal is to provide that connection.”

Source: Tech Crunch Startups | Kenshō Health publicly launches its ‘antithesis of Goop’