Atari founder Nolan Bushnell once said that the best video games are easy to learn and nearly impossible to master.

I believe that a related concept holds for building foundational consumer internet companies. Two characteristics that I always look for in startups are the founder’s ability to describe what they do in less than five seconds, and a product or service that’s exceptionally hard to build well. Those two characteristics may sound as though they’re in opposition, but it turns out that the best companies can be simultaneously very easy to understand and very hard to do.

A successful consumer internet company must be easy to understand

“In a world of abundance, the only scarcity is human attention.” — Kevin Kelly, The Inevitable

Humans have short attention spans, and the competition for mindshare has never been greater. Today, the most successful products in consumer internet tend to be those that achieve high degrees of virality. Word of mouth, in particular, is an especially important driver of distribution for world-class products. Only products that are extremely simple to understand — such as DoorDash, Niantic or Coinbase — can thrive in the telephone-chain word-of-mouth distribution channel.

Here’s an example: Imagine talking with a friend about something like Doppler Labs’ Here One earbuds. Though this hardware product had standout features and was unlike other earbuds on the market, it was difficult to explain what made them special. A conversation might sound something like, “They’re kind of like headphones, but really, they’re augmented reality for audio. You can phase in and out background noise. No, it’s not the same as adjusting volume or noise-canceling… but yes, you can use them to listen to music.” It’s not hard to predict that a message like this might not easily catch on.

Compare this to a product like Robinhood. You might say something such as, “It’s an app to buy and sell stocks on your phone without paying commission.” The succinct description instantly showcases the company’s value for consumers, and it’s memorable. Most people can understand how the product works, which makes it clear why Robinhood’s message sticks and can generate strong word-of-mouth distribution.

The less obvious insight is that this phenomenon can also work in startups’ benefit to attract capital. Founders who can quickly articulate their product and business model have the advantage of appealing to a large amount of investors.

Even more, a product or startup must be hard to do

Being able to concisely describe what a company does is just one part of the blueprint for success. While having a message and value proposition that are easy to understand and talk about are critical to growth, to become extremely valuable a startup must also build a product that’s hard to do.

Some verticals, like direct-to-consumer brands, can have a large number of companies that offer a similar product even after some have reached a moderate scale. While it’s never been easier to get to market with a new product in this vertical (good), it’s also a lot less likely for a single, super valuable company to capture the entire market (bad, at least from the perspective of a venture capitalist).

In contrast, when a business builds something that is hard to do well, they effectively construct a moat, or a sustainable competitive advantage. Nearly all startup pitches include a conversation around moats and the barrier to entry, and rightfully so. Building a moat allows a company to become a compounding franchise and accrue outsized profits over the long run.

The blueprint for consumer success

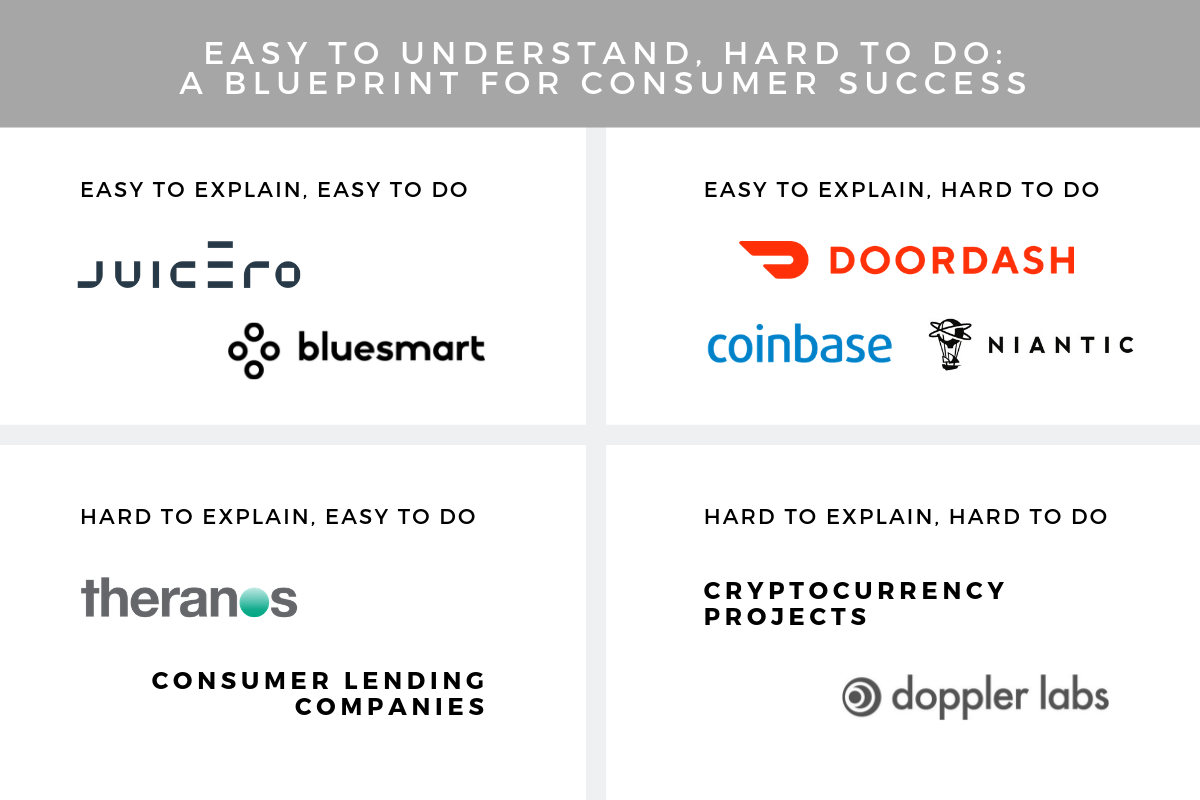

Using this framework, companies can be classified into one of four quadrants when we evaluate whether or not they follow the blueprint for consumer success.

Easy to understand, hard to do

As described, this is the magic quadrant for consumer internet companies. Companies in this quadrant have a simple message that can be explained in five seconds or less, along with a component that’s hard to do. This may be an engineering build, regulatory approvals, cracking a network effect at scale or building a brand that resonates:

- Coinbase: Crypto is a notoriously complex vertical to understand, but the magic of Coinbase is that it doesn’t require a person to have any specific knowledge to use the product. By abstracting away the complexities of safely buying and storing crypto, Coinbase brought crypto to the mass market. Despite the simplicity of Coinbase’s product, the infrastructure that makes it possible is one of the most sophisticated engineering builds I’ve ever seen. For instance, keeping 98%+ of crypto deposits in cold storage while enabling instantaneous transaction ability is not a straightforward feat or something that people think about, but it’s critical to the ultimate product experience. Even more, the security infrastructure is a moving target that requires Coinbase to constantly innovate. Coinbase also remains one of the few scaled crypto exchanges/brokerages that have never been hacked.

- Niantic: Niantic is a mobile game producer and the maker of Pokémon GO and Harry Potter: Wizards Unite. Niantic lands in the “easy to understand, hard to do” category because the best games need little explanation; players simply open the app and start playing. Yet, there are few other companies that could successfully replicate the infrastructure that supports 100 million simultaneous instances in a single shared world geospatial game.

- DoorDash: While DoorDash offers a drop-dead simple value proposition of better food delivery, the company has actually built a highly sophisticated software and operations stack that is really a next-generation last-mile logistics backbone. Much like FedEx or UPS, which were really software companies with trucks and drivers on the front end, DoorDash software controls every step of the process, from order batching, timing of food preparation, traffic analysis and driver availability. DoorDash has largely out-executed competition because they recognized that better software and operations unlock a better product and a better business. For example, they solved reserved parking for dashers, and partnered with national chains to expand to non-urban markets. DoorDash also had to crack sufficient density in a geo-specific three-sided marketplace (restaurants, dashers, consumers), which is no small task.

Easy to understand, easy to do

Companies that are easy to understand may be able to get widespread, frictionless distribution, but those that are easy to do fall usually short when it comes to building a moat, or genuine competitive advantage. Brilliant marketing is not enough to prevent duplication, and business models that can be copied with something as simple as contract manufacturing may soon find themselves sidelined by competitors:

- Juicero: No example comes to mind more quickly than Juicero. The Juicero Press was an expensive Wi-Fi-connected device that utilized single-serving, pre-juiced fruit and vegetable packets sold via an exclusive subscription model. Juicero was easy to explain, but its technology wasn’t truly hard to do. Customers caught on to the fact that they didn’t actually need their device or Wi-Fi to make juice with the packets — they could do it with their hands by squeezing the packs. And there were significant alternatives in the market. The company shut down after 16 months in business.

- BlueSmart: BlueSmart, a smart luggage company, serves as another good example of a company that was easy to understand and had a clear use case. Unfortunately, there was little about the product that was hard to do — it faced stiff competition from other smart suitcase companies as well as incumbents. Away, for example, came to market at a similar time and was able to out-execute on brand. The final blow came when airlines began banning lithium batteries, which the company decided they wouldn’t be able to sufficiently differentiate without.

Hard to understand, hard to do

Companies that are hard to do — perhaps they offer multiple products or elaborate models — can be difficult to articulate, which often causes the message to become distorted. As a result, these companies often have low virality. They can experience the same fate when it comes to attracting capital, as only a narrow set of investors will feel comfortable understanding the scope of what they do:

- Doppler Labs: As mentioned, Doppler Labs headphones were hard to explain. They were different than any other headphones on the market and needed to be distinguished as such, but people failed to understand what set them apart and why they were valuable. While the technology to build the product may have been hard to do, that alone was insufficient to create a valuable company.

- Cryptocurrency projects: “Crypto projects” are those where the core of the product (and often the investment security) requires at least some understanding of the cryptographic math and token economics to grasp what’s special about what they’re doing. Crypto projects are naturally harder to do because the nuts and bolts of crypto are complicated. That said, some of the most articulate founders in crypto can communicate their projects as easily as one can communicate a consumer marketplace.

Hard to understand, easy to do

Companies that are hard to understand and easy to do are the least appealing to investors, as they have a message that’s hard for consumers to grasp and low virality. They will struggle to build a moat. Put simply, they lack a real competitive advantage and are difficult to grow:

- Consumer lending companies: Undifferentiated consumer lending companies often have models, investment criteria or loan requirements that are hard for investors to understand. Though there may be moving parts, many lending companies rely on a simple funding and underwriting model that does the same thing: Checks a borrower’s credit score and/or bank account, connects to sources of capital and then originates the loan. Without anything special to differentiate it, a lending company may be easily forgotten in a crowded space.

- Theranos: Theranos marketed itself as a new kind of healthcare company that could run lab tests with smaller amounts of blood in a shorter period of time; a paradigm shift in healthcare diagnostics. The various testing devices and panels made it difficult to understand exactly what the company did — and it turned out that they were doing something that was actually quite easy. Despite claims that it had created disruptive technology, the company was running standard blood tests (and doing so poorly) that lacked innovation. While it may have been fraud that brought down the company, the reality is that even if Theranos had told the truth about what they were actually doing, it’s unlikely they would have attracted significant capital to begin with.

Consumer internet companies can set themselves up for success early on by ensuring they can clearly speak to what they do, making it easy for people to understand and share the product and its value. A thoughtful approach to building something that’s difficult to do will go a long way when establishing a competitive advantage. This will also set a startup apart, attract investors and customers and help the company thrive in a crowded space for the long run.

Special thanks to Steve Mullaney, the CEO of our portfolio company Aviatrix, for sparking this topic. He recently brought up this great concept (easy to understand, hard to do) when we talked about enterprise, and it inspired me to explore how the idea applies to consumer internet.

Source: Tech Crunch Startups | Consumer internet companies are easy to understand, but hard to create