Source: Engadget | Twitter lets you appeal suspensions in the app for a faster response

- Walgreens Boots Alliance, Inc (WBA) CEO Stefano Pessina on Q2 2019 Results – Earnings Call Transcript Seeking Alpha

- Walgreens Shares Drop on Dire Earnings Outlook Bloomberg Markets and Finance

- The worst isn’t over for Walgreens CNN

- The Retail Apocalypse Now Threatens Drugstores, Too Bloomberg

- Walgreens: The Ship Isn’t Sinking – Yet Seeking Alpha

- View full coverage on Google News

- Chemical plant blast leaves 1 dead, Houston communities on edge ABC News

- Huge explosion and fire rocks Texas chemical plant ABC News

- One dead, two critically injured in Crosby plant fire KPRC Click2Houston

- One dead in fire at KMCO chemical plant in Crosby Chron.com

- Chemical plant fire near Houston kills 1 CNN

- View full coverage on Google News

Andreessen Horowitz isn’t alone in leaving behind VC as we know it — and more company is coming

April 2, 2019This morning, Forbes wrote a lengthy profile of Andreessen Horowitz, the now 10-year-old venture firm that its rivals love to hate but nevertheless tend to copy. It’s a great read that revisits some of the firm’s wins and losses and, interestingly, regrets, including the founders’ early predisposition to talk trash about the rest of the venture industry.

As Ben Horowitz tells reporter Alex Konrad, “I kind of regret it, because I feel like I hurt people’s feelings who were perfectly good businesses . . . I went too far.”

The story also suggests that Andreessen Horowitz — whose agency-like model has been widely replicated by other big venture firms — is re-shaping venture capital a second time. It’s doing this, says Forbes, by turning itself into a registered investment advisor.

But the firm isn’t alone is morphing into something very different than it once was, including an RIA. SoftBank is already one. General Catalyst appears to be in the process of registering as one, too. (It recently withdrew its status as a so-called exempt reporting advisor.) Other big firms with a range of un-VC-like products are similarly eyeing the same move.

They don’t have much choice. While VCs have traditionally been able to dabble in new areas through their limited partner agreements with their own investors, they’ve also faced what’s traditionally been a 20 percent cap on these activities, like buying in the public markets, investing in other funds, issuing debt to fund buyouts, and acquiring equity through secondary transactions.

Put another way, 20 percent of their capital could be used to experiment, but the rest had to be funneled into typical venture capital-type deals.

For Andreessen Horowitz, that cap clearly began to grate. An early and enduring believer in cryptocurrencies, marketplaces, and applications, the firm grew particularly frustrated over its inability to invest more of its flagship fund into crypto startups. It raised a separate crypto fund last year so it could move more aggressively on opportunities, but according to Forbes, the constraints that came with creating that separate legal entity gave rise to new aggravations.

By becoming a registered investment advisor, Andreessen Horowitz will no longer have to limit its stakes, including in its general fund — the newest of which it’s expected to announce shortly. It will also have the freedom to invest any percentage of its fund that it wants in larger high-growth companies, to buy shares from founders and early investors, and to trade public stocks, as Forbes notes.

It’s the same reason that SoftBank is a registered investment advisor and other big firms with more assets will invariably be, as well. As longtime startup attorney Barry Kramer observes, “Like the now-giant operating companies that VCs once funded, like Google and Apple and Amazon, each of which used to play in discrete market segments and now overlap, hedge funds, mutual funds, secondary funds, and venture funds that used to play in discrete market segments are starting to overlap, too.”

In fact, the opportunity to shop for secondary stakes alone could drive a venture firm to restructure. “Secondary markets are eating” the public markets, observes Barrett Cohn on the investment bank Scenic Advisement, which helps broker sales between equity buyers and sellers. Cohn has a vested interest in this turnabout, but it’s also hard to argue he’s wrong, considering how long startups remain private, and how much more secondary activity now takes place before companies are acquired, go public, or conk out.

Little wonder the powerful venture capital lobby group — the National Venture Capital Association — has been trying to talk the SEC into changing its definition of what constitutes a venture capital firm. It recognizes that it will lose more and more members if venture firms aren’t afforded more flexibility.

Still, becoming an RIA isn’t without its downsides — a lot of them, notes Bob Raynard, the managing director of the fund administration services company Standish Management in San Francisco.

Though he thinks many firms like Andreessen Horowitz may not have a choice past a certain point (“I think there are a lot of other growth equity and venture firms that should be registered for their own sake”), the new rules to which it will be adapting can “be quite onerous,” including a complete lack of privacy, as well as associated expenses. One estimate we found suggests that the median annual compliance costs are eight times higher for RIAs than for exempt registered advisors.

“If [Andreessen Horowitz] is becoming an RIA, its cost structure just went way up,” says Raynard, explaining that a compliance officer will have to sign off on everything an employee at the firm does, as well as the investing decisions that its partners’ spouses, children, and even parents make. “As a VC, you don’t have to report your trades,” Raynard notes, but an RIA has to ensure that nothing and no one with a pecuniary interest in the firm creates an expensive misstep.

It could also conceivably create headaches for limited partners, who typically like to invest in distinct asset classes, whether venture capital or private equity or hedge funds. If Andreessen Horowitz, among other firms, starts to look like an amalgamation of all three, how will it be viewed? In which bucket will it land?

The firm declined to answer that question and others of ours today, saying it’s focused for now on completing the process of registering as an RIA.

Raynard meanwhile pushes back on the idea that its new look might throw off the institutions that have long funded it “I think regulators will view it as a good thing, and I think most LPs would view it as a favorable shift, because of increased outside scrutiny involved.” He thinks a bigger issue for venture firms that become investment firms more broadly — beyond the expenses and the added layers of management needed and an eagle-eyed SEC watching more closely — could be that it becomes harder to recruit.

Despite widespread interest in working for a brand-name firm, “if you’re a junior-level person and you’re being recruited by a firm that’s a registered investment advisor versus a venture firm where your deals are not being scrutinized and you have some privacy,” says Raynard, “it’s something you’re going to think about.”

Source: Tech Crunch Startups | Andreessen Horowitz isn’t alone in leaving behind VC as we know it — and more company is coming

Walgreens Boots Alliance, Inc (WBA) CEO Stefano Pessina on Q2 2019 Results – Earnings Call Transcript – Seeking Alpha

April 2, 2019Source: Google News | Walgreens Boots Alliance, Inc (WBA) CEO Stefano Pessina on Q2 2019 Results – Earnings Call Transcript – Seeking Alpha

Source: Google News | Chemical plant blast leaves 1 dead, Houston communities on edge – ABC News

FDA proposes new fluoride standard for bottled water, but some say it's still too high – CNN

April 2, 2019FDA proposes new fluoride standard for bottled water, but some say it’s still too high CNN

The FDA is proposing a lower concentration level standard for fluoride in bottled water, yet some scientists and environmental groups believe the proposed limit …

Source: Google News | FDA proposes new fluoride standard for bottled water, but some say it's still too high – CNN

Source: Engadget | Google sets baseline standards for temp workers after outcry

BuzzFeed and Eko have been working together to create a wide range of interactive videos, which they began launching in the past week or so — starting with this Tasty potato recipe that allows you to customize your ingredients, revealing a bit about your personality in the process.

There’s also an interactive Tarot reading, a video quiz that determines which kind of dog you are and this customizable ramen video.

I spoke with BuzzFeed and Eko executives last week to learn more about how they’re working together, and where it might go next.

These videos — usually brief and based on existing BuzzFeed formats — feel pretty different from previous Eko showcases like “That Moment When,” which is more of a comedic, Choose Your Own Adventure-style story.

Eko’s Chief Creative Officer Alon Benari acknowledged that in the past, the company usually “started from a traditional video and injected interactivity into it.” But while “this is one of the first projects where we did the other path” — namely, taking an interactive format like a quiz and introducing video — the focus is still on “bringing together the best of both worlds.”

“This isn’t a direction change,” added Vice President of Business Development Ivy Sheibar. “We have a full pipeline of what you would consider coming more from traditional video.”

As for BuzzFeed, Chief Marketing Officer Ben Kaufman suggested that this is a natural extension of the publisher’s strategy to experiment with new formats. By offering this kind of interactivity, BuzzFeed can tailor videos to their viewers’ needs and interests (for example, by customizing video recipes based on dietary restrictions) while also “allowing our audience to engage with our videos and create data feedback loops.”

In addition to providing the technical platform to create these videos, Kaufman said Eko’s team shared important insights from years of experience with interactivity.

“One of the things they trained us on was what the meaning of a meaningful choice was — [a choice] where actually as an audience member you would take that to heart and makes you feel like, ‘This video is really made for me,’ ” he said.

Kaufman added that as BuzzFeed and Eko continue rolling out different types of interactive videos, “Our goal in the next few weeks is to crack this, to build a real deep audience connection, see what they are loving and go heavy into scaling that.”

Source: Tech Crunch Startups | BuzzFeed teams up with Eko to create interactive recipes and other videos

Source: Engadget | Boston Dynamics' acquisition will help its robots see in 3D

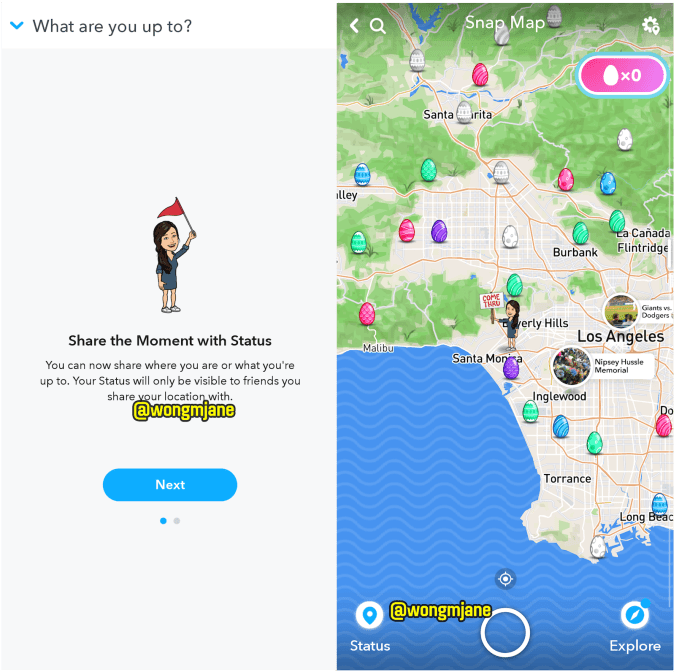

Today’s teens missed the Foursquare era, so Snapchat is giving them another shot with a new feature to aid in-person meetups. Snapchat is now testing Status, an option to share to the Snap Map a Bitmoji depicting what you’re up to at a certain place. You could show your little avatar playing video games, watching TV, asking friends to hit you up and more. And Snapchat will compile these into a private diary of what you’ve been doing, called Passport

This fixes the biggest problem with Snap Map and many other location check-in apps. Just because someone is down the street doesn’t mean they want you to drop in on them. They could working, in a meeting or on a date. Snapchat Status lets people convey their activity and intention so you can tell the difference between “I’m nearby but stuck with my parents” and “I’m nearby and want to hang out!” As Snapchat refocuses on messaging after Instagram stole its Stories thunder, Status could ensure there’s more to see that makes Snap Map worth opening.

Meanwhile, “Passport is Just For You: Passport helps you keep track of the Places you’ve been. Places you set your Status at will be added to your Passport along with who you were there with. Only you ca see your Passport, and you can delete a Place from your history at any time.” Your Status only lasts until you leave a place, but it’s tallied along with the number of countries and cities you’ve check into on your Passport.

A Snap spokesperson confirms that “Yes, we are currently testing new ways for Snapchatters to better communicate on the Snap Map with their friends. This test is running with a percentage of Snapchatters in Australia.” Previously, special Bitmoji were only displayed on the Snap Map involuntarily, like when you were road tripping or flying to a new place; visited somewhere special like a beach, mall or major event; or if there was a breaking news moment.

If you don’t want to use Status or even show up on Snap Map, you can go into ghost mode at any time, plus all your location-based content disappears if you don’t open the app for eight hours. And if you do want to be found, you can check who’s viewed your location or Status in case you need to know who’s blowing you off.

Snap launched Snap Map back in June 2017, basing the idea off its acquisition of French location startup Zenly that it bought for $213 million in cash plus bonuses. Beyond spurring real-world interaction, Snap has also made Snap Map an embeddable way to explore breaking news events or hotspots around the world. Status could provide structured data about your behavior, which could beef up Snapchat’s scrawny repository of ad-targeting information. The app could even try surfacing nearby businesses or discounts.

Snapchat’s tighter-knit social graph and stronger track record on privacy lets it offer features that would freak people out if built by Mark Zuckerberg. Given Facebook is aggressively cloning Snap’s whole product philosophy, from its direct copy of Stories to ephemeral messaging to its premium content hubs Watch and IGTV, Snapchat desperately needs to differentiate. Luckily, Facebook has failed to figure out offline meetups, and has yet to roll out the “Your Emoji” status feature that similarly tries to convey what you’re up to visually but within Messenger instead of a map.

Doubling down on Snap Map is a smart move because its one of the few areas where Facebook can’t follow.

Source: Tech Crunch Mobiles | Foursnap? Snapchat tries ‘Status’ location check-ins

Source: Engadget | Open Curbs database could make it easier to catch an Uber